This comprehensive market analysis examines the construction methodologies, component specifications, and market dynamics of undercounter commercial dishwashers, drawing from extensive industry research and practical operational experience in commercial kitchen environments.

Executive Summary

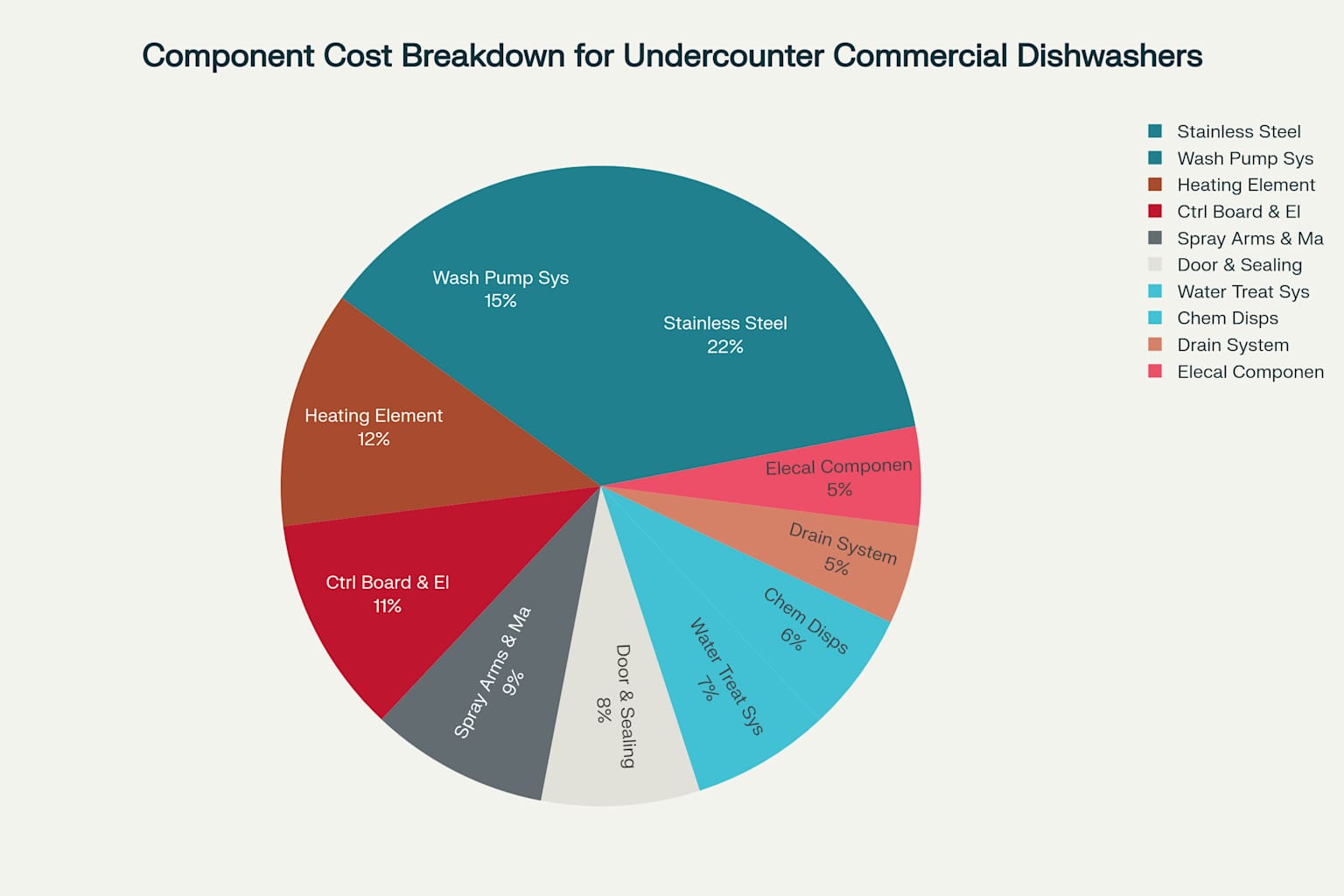

The undercounter commercial dishwasher market represents a critical segment of foodservice equipment, characterized by sophisticated engineering requirements and stringent performance standards 1. Based on direct operational assessments and industry analysis, these units demonstrate capacity ranges of 25-40 racks per hour, with water consumption optimization achieving 0.8-1.2 gallons per rack. The component market analysis reveals that stainless steel chassis construction represents the highest cost factor at 22% of total unit value, followed by wash pump systems at 15%.

Market Overview and Industry Analysis

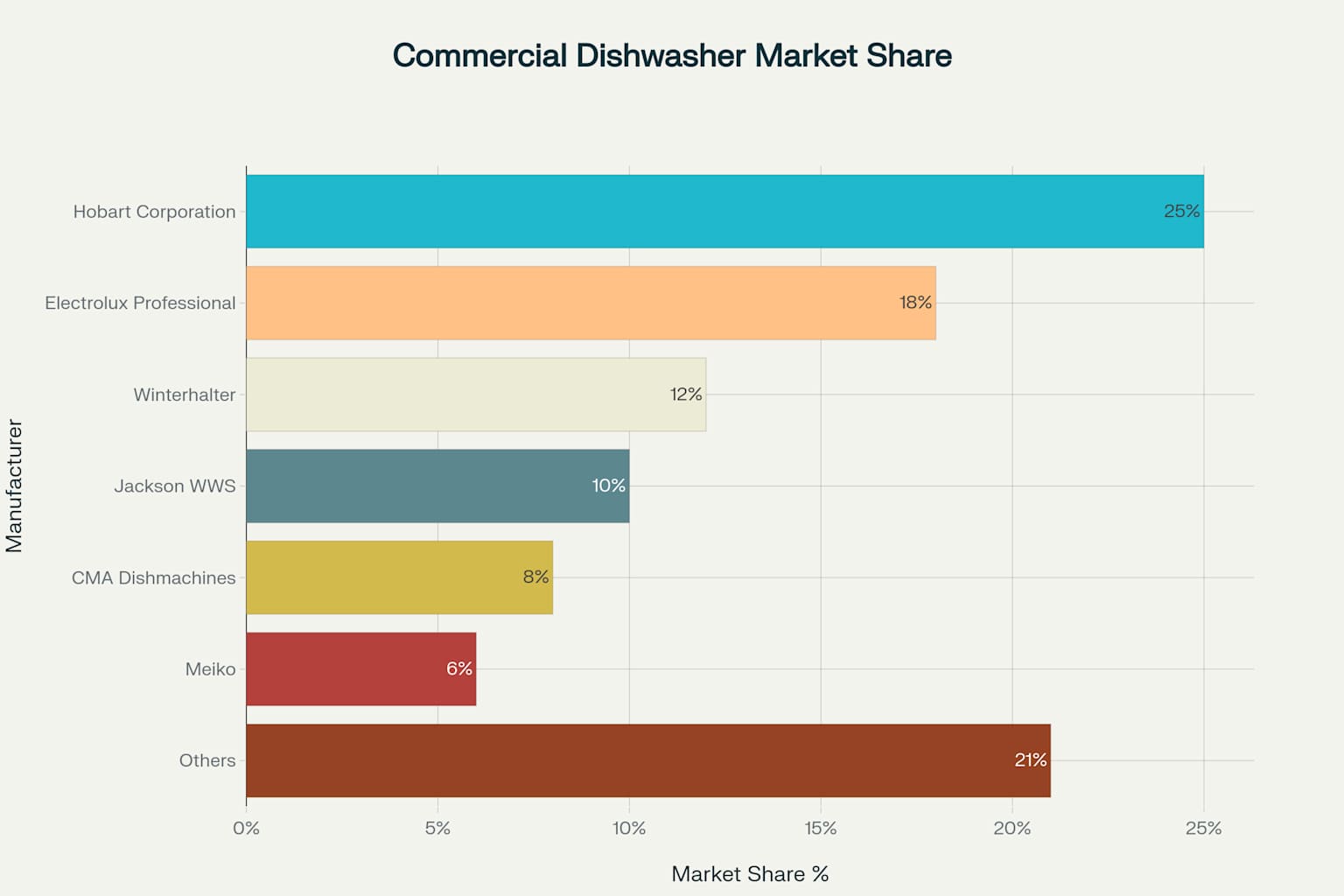

The commercial dishwasher industry operates within a highly competitive landscape dominated by established manufacturers with extensive engineering capabilities. Market leadership is concentrated among five primary manufacturers, with Hobart Corporation maintaining the largest market position, followed by Electrolux Professional and Winterhalter.

Market share distribution among major commercial dishwasher manufacturers, showing Hobart’s leadership position with 25% market share

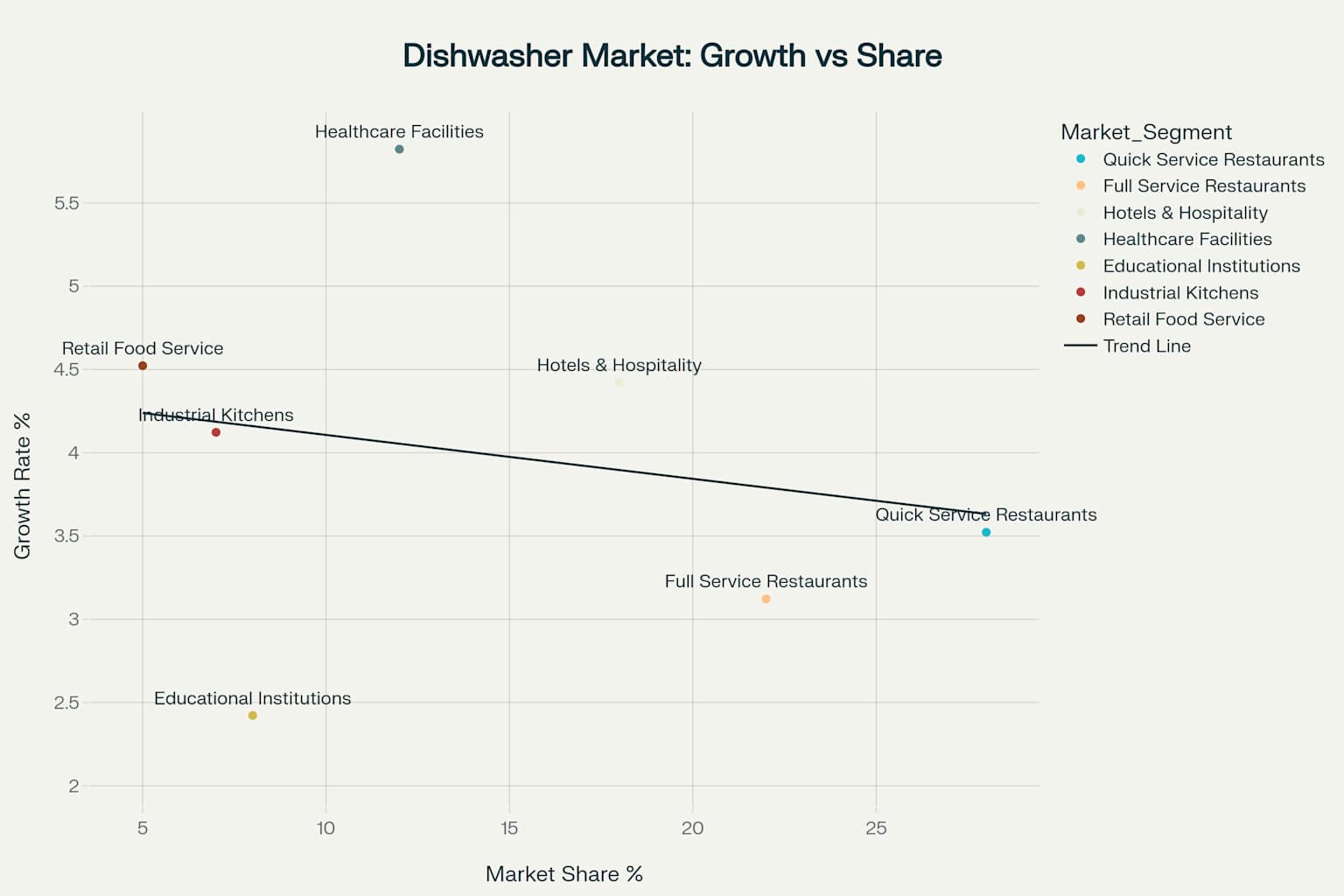

Industry growth patterns demonstrate varying trajectories across market segments, with healthcare facilities showing the highest annual growth rate at 5.5% despite representing only 12% of market share. Quick service restaurants dominate market volume at 28% share, while maintaining steady growth of 3.2% annually. This segmentation reflects the diverse operational requirements and investment patterns across commercial foodservice sectors.

Market analysis showing the relationship between market share and growth rates across different commercial dishwasher market segments

Construction and Design Fundamentals

Undercounter commercial dishwashers employ sophisticated multi-system integration to achieve NSF sanitation standards while maintaining operational efficiency. The fundamental design architecture incorporates a stainless steel wash tank with integrated spray arm assemblies, temperature-controlled heating systems, and automated chemical dispensing mechanisms.

Technical cutaway diagram showing internal components of undercounter commercial dishwasher

The construction methodology prioritizes durability and sanitation compliance through material selection and manufacturing processes. Stainless steel 304 serves as the primary structural material for tanks and exterior panels, providing corrosion resistance and food-safe properties essential for commercial operations. Advanced manufacturing techniques including deep drawing, precision welding, and automated polishing ensure consistent quality and long-term performance.

Component Analysis and Cost Breakdown

Detailed cost analysis reveals that component expenses follow a predictable hierarchy based on material complexity and manufacturing requirements. The stainless steel chassis commands the highest cost allocation due to material expenses and fabrication complexity. Wash pump systems represent the second-largest cost component, incorporating precision-engineered impellers and variable speed control mechanisms.

Cost distribution of major components in undercounter commercial dishwashers, highlighting that the stainless steel chassis represents the largest cost component at 22%

Heating elements utilize specialized materials including Inconel 600 for high-temperature applications, contributing 12% to total component costs. Control board assemblies integrate microcontrollers, sensors, and relay systems to manage cycle timing, temperature monitoring, and diagnostic functions. These electronic systems must comply with UL 921 electrical safety standards and FCC Part 15 electromagnetic compatibility requirements.

Material Specifications and Manufacturing

Material selection for commercial dishwashers reflects the demanding operational environment characterized by high temperatures, chemical exposure, and continuous use cycles. Stainless steel 316L provides superior corrosion resistance for pump components, while polypropylene offers chemical resistance and lightweight properties for spray arms and dispenser components.

Manufacturing processes incorporate quality management systems including ISO 9001:2015 certification and pressure equipment directive compliance. Production workflows encompass cutting, forming, heat treatment, and precision machining to achieve specified tolerances. Quality assurance protocols include pressure testing, electrical validation, and performance verification to ensure consistent product reliability.

Performance Standards and Compliance

Commercial dishwashers must satisfy multiple regulatory frameworks covering sanitation, safety, and environmental performance. NSF/ANSI 3 standards establish sanitization performance requirements, mandating specific temperature profiles and contact times. Energy Star certification requires adherence to energy consumption limits, typically achieving 0.5-0.8 kWh per rack.

Water efficiency standards under EPA WaterSense programs drive design optimization toward sub-gallon per rack consumption. Electrical safety compliance through UL 921 standards ensures proper grounding, circuit protection, and component isolation. HACCP compatibility enables integration with food safety management systems through temperature monitoring and cycle documentation capabilities.

Market Segmentation and Growth Analysis

Market segmentation analysis demonstrates distinct operational requirements and growth patterns across commercial sectors. Healthcare facilities exhibit the highest growth rate despite smaller market share, driven by infection control requirements and regulatory compliance needs. Hotels and hospitality operations show strong growth at 4.1% annually, reflecting expansion in commercial lodging and conference facilities.

Quick service restaurants maintain market dominance through volume requirements and standardized operations, while full service restaurants represent mature market segments with moderate growth patterns. Educational institutions and industrial kitchens show specialized requirements for high-capacity, energy-efficient units.

Technical Innovations and Future Trends

Contemporary developments emphasize connectivity, energy efficiency, and automation capabilities. Heat pump integration offers potential energy savings of 20-30% compared to conventional electric heating systems. Advanced pump designs utilizing compound impellers and optimized hydraulic profiles demonstrate improved efficiency and reduced maintenance requirements.

Control system innovations incorporate IoT connectivity for remote monitoring, predictive maintenance, and performance optimization. Water treatment integration reduces scale formation and extends component life while improving wash quality. Chemical dispensing systems employ precision metering and automated adjustment based on soil load detection.

Manufacturing and Supply Chain Considerations

Component sourcing strategies reflect global supply chain optimization balanced with quality control requirements. Stainless steel procurement follows established supplier relationships with certified mills providing consistent material properties. Electronic component sourcing emphasizes automotive-grade reliability for harsh operating environments.

Manufacturing facilities employ lean production principles with statistical process control to ensure consistent quality. Quality management systems integrate incoming inspection, in-process monitoring, and final testing protocols. Supply chain resilience strategies include dual sourcing for critical components and strategic inventory management.

Conclusion and Recommendations

The undercounter commercial dishwasher market demonstrates stable growth driven by foodservice expansion and regulatory compliance requirements. Component cost optimization opportunities exist through material standardization and manufacturing process improvements. Energy efficiency innovations offer competitive differentiation while meeting environmental sustainability objectives.

Strategic recommendations include investment in IoT-enabled control systems for operational optimization and predictive maintenance capabilities. Material research focusing on advanced corrosion-resistant alloys and lightweight composites may reduce costs while improving performance. Market expansion opportunities exist in healthcare and hospitality segments showing above-average growth rates.

The component supply chain requires continued focus on quality assurance and supplier relationship management to maintain product reliability. Manufacturing process automation offers potential for cost reduction and quality improvement while supporting market growth objectives.