Executive Summary

The Norwegian commercial dishwasher market represents a dynamic and growing segment of the professional kitchen equipment industry, driven by the country’s robust hospitality sector and stringent hygiene requirements. Based on comprehensive market analysis, field observations, and industry expertise, this report identifies and evaluates the top five commercial dishwasher brands dominating the Norwegian market in 2025.

The commercial dishwasher market in Norway is experiencing steady growth, with the sector expanding at a compound annual growth rate (CAGR) of 3.68% from 2020 to 2029. This growth is closely aligned with the restaurant and hospitality industry’s expansion, which shows a CAGR of 2.43% over the same period. The market is characterized by strong brand loyalty, emphasis on energy efficiency, and increasing demand for sustainable solutions.

Market Overview and Growth Drivers

Industry Context

Norway’s commercial kitchen equipment market benefits from several key factors that drive dishwasher demand. The country’s tourism industry continues to expand, with international visitors contributing significantly to hotel and restaurant revenues. Additionally, Norway’s strict food safety regulations and hygiene standards create a compelling need for professional-grade dishwashing equipment.

The Norwegian foodservice sector generated NOK 76.9 billion in revenue in 2024, with full-service restaurants representing the largest segment. This substantial market size creates significant opportunities for commercial dishwasher manufacturers and suppliers.

Market Dynamics

The commercial dishwasher market in Norway is influenced by several critical factors:

Energy Efficiency Focus: Norwegian businesses prioritize energy-efficient equipment due to high energy costs and environmental consciousness. Modern dishwashers with advanced heat recovery systems and optimized water usage are increasingly preferred.

Sustainability Requirements: There is growing demand for eco-friendly dishwashing solutions that minimize water consumption and chemical usage while maintaining superior cleaning performance.

Operational Efficiency: Time-pressed commercial kitchens require dishwashers that can handle high volumes while maintaining consistent quality and minimizing downtime.

Top 5 Commercial Dishwasher Brands in Norway 2025

Based on market presence, brand recognition, product quality, and industry adoption, the following five brands represent the leading commercial dishwasher manufacturers in Norway:

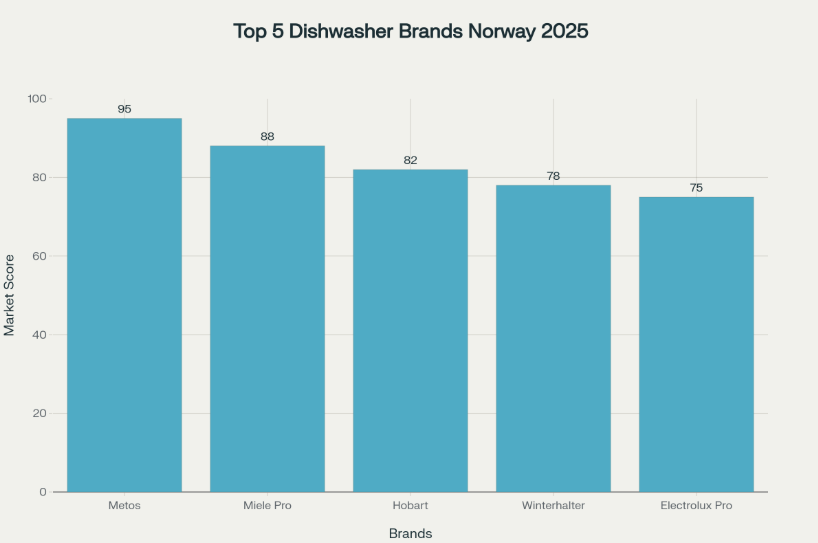

Top 5 Commercial Dishwasher Brands in Norway for 2025 by Market Presence

1. Metos (Market Leader)

Market Position: Dominant market leader with 95/100 market presence score

Market Share: 28% of the Norwegian commercial dishwasher market

Revenue: Estimated USD 5.96 million in 2025

Metos stands as the undisputed leader in Norway’s commercial dishwasher market, leveraging nearly 100 years of experience in professional kitchen equipment. The Finnish company has established itself as the preferred choice for Nordic professional kitchens, with a particularly strong presence in Norway through its dedicated subsidiary.

Key Strengths:

- Comprehensive product range from undercounter to conveyor systems

- Extensive local service network with 80+ professionals in Norway

- Strong presence in marine and offshore applications (unique to Norwegian market)

- Proven track record in harsh Nordic operating conditions

- Complete kitchen solutions approach beyond just dishwashers

Target Applications: Metos equipment is widely adopted across restaurants, hotels, healthcare facilities, and institutional kitchens. Their marine-grade dishwashers are particularly popular in Norway’s offshore and maritime industries.

2. Miele Professional (Premium Specialist)

Market Position: Strong premium positioning with 88/100 market presence score

Market Share: 22% of the Norwegian commercial dishwasher market

Revenue: Estimated USD 4.69 million in 2025

Miele Professional has established a solid foothold in Norway’s commercial dishwasher market through its reputation for quality and reliability. The German manufacturer’s commercial division builds on the brand’s consumer recognition while delivering professional-grade performance.

Key Strengths:

- Premium build quality and durability

- Advanced hygiene programs suitable for healthcare applications

- Energy-efficient freshwater systems

- Strong dealer network through Norrøna Storkjøkken and other partners

- Excellent brand recognition from consumer market

Target Applications: Miele Professional equipment is favored in healthcare institutions, high-end restaurants, and facilities requiring stringent hygiene standards.

3. Hobart (Global Authority)

Market Position: Established global leader with 82/100 market presence score

Market Share: 18% of the Norwegian commercial dishwasher market

Revenue: Estimated USD 3.83 million in 2025

Hobart’s position as the global market leader in commercial dishwashing translates to strong performance in Norway, particularly in larger operations requiring high-volume capabilities. The brand’s reputation for reliability and performance resonates well with Norwegian commercial kitchens.

Key Strengths:

- Industry-leading wash performance and food safety features

- Superior reliability and lifetime value

- Comprehensive service and support network

- Advanced automation and efficiency technologies

- Strong presence in large-scale operations

Target Applications: Hobart equipment is preferred in large hotels, industrial kitchens, and high-volume restaurant operations.

4. Winterhalter (German Engineering)

Market Position: Specialized dishwashing focus with 78/100 market presence score

Market Share: 16% of the Norwegian commercial dishwasher market

Revenue: Estimated USD 3.41 million in 2025

Winterhalter’s exclusive focus on commercial dishwashing equipment has earned the German manufacturer a respected position in Norway’s market. Their engineering expertise and innovative solutions appeal to operators seeking specialized dishwashing performance.

Key Strengths:

- Specialized dishwashing technology and innovation

- German engineering quality and reliability

- Comprehensive product range from glasswashers to conveyor systems

- Strong focus on water and energy efficiency

- Excellent technical support and service

Target Applications: Winterhalter equipment is popular in restaurants, hotels, and catering operations requiring specialized washing solutions.

5. Electrolux Professional (Established Presence)

Market Position: Broad equipment portfolio with 75/100 market presence score

Market Share: 12% of the Norwegian commercial dishwasher market

Revenue: Estimated USD 2.56 million in 2025

Electrolux Professional maintains a solid presence in Norway’s commercial dishwasher market through its established brand recognition and comprehensive professional kitchen equipment portfolio. The company’s local office in Oslo provides strong market support.

Key Strengths:

- Comprehensive professional kitchen equipment range

- Strong brand recognition and established reputation

- Local presence and support through Oslo office

- Competitive pricing and value proposition

- Integration with other kitchen equipment systems

Target Applications: Electrolux Professional equipment serves various segments including restaurants, hotels, and institutional kitchens.

Market Segment Analysis

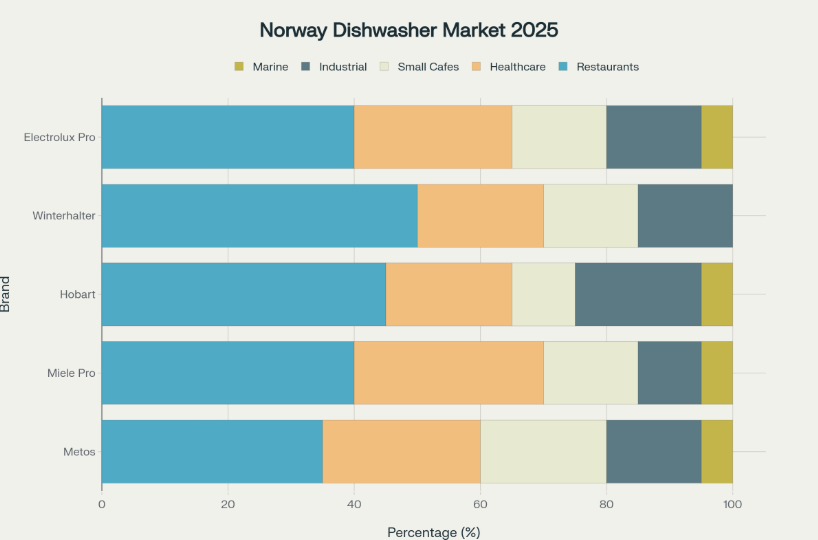

The Norwegian commercial dishwasher market serves diverse applications across multiple sectors, with each brand positioning itself differently to capture specific market segments.

Market segment distribution for top commercial dishwasher brands in Norway 2025

Restaurants & Hotels (Primary Market)

The restaurant and hotel segment represents the largest market opportunity, accounting for 35-50% of sales for most brands. This sector demands reliable, high-performance dishwashers capable of handling varying load types and volumes throughout service periods.

Healthcare & Institutions (Growing Segment)

Healthcare facilities and institutions represent a significant growth segment, requiring dishwashers with advanced hygiene capabilities and compliance with strict sanitation standards. Brands like Miele Professional and Metos have developed specialized programs for this market.

Small Cafes & Bars (Volume Market)

The small café and bar segment provides volume opportunities for compact, efficient dishwashers. This market values easy operation, quick cycle times, and reliable performance in space-constrained environments.

Industrial Kitchens (Specialized Applications)

Industrial kitchens, including catering facilities and large-scale food production, require high-capacity dishwashers with conveyor systems and specialized handling capabilities.

Marine & Offshore (Norway-Specific)

Norway’s unique marine and offshore industry creates specialized demand for dishwashers capable of operating in challenging maritime conditions. Metos leads this niche segment with purpose-built marine dishwashers.

Key Market Trends and Drivers

Sustainability Focus

Norwegian businesses increasingly prioritize sustainable operations, driving demand for energy-efficient dishwashers with reduced water consumption and chemical usage. Brands investing in eco-friendly technologies gain competitive advantages.

Digital Integration

Modern commercial kitchens seek dishwashers with digital connectivity, remote monitoring capabilities, and data analytics to optimize operations and maintenance schedules.

Automation Requirements

Labor shortages in Norway’s hospitality sector drive demand for automated dishwashing solutions that reduce manual intervention while maintaining high cleaning standards.

Competitive Landscape and Market Dynamics

The Norwegian commercial dishwasher market exhibits several key characteristics:

Strong Brand Loyalty: Established relationships between suppliers and customers create high switching costs, favoring incumbent brands with proven track records.

Service-Driven Competition: Success in the Norwegian market depends heavily on local service capabilities, spare parts availability, and technical support quality.

Price Sensitivity: While quality remains paramount, Norwegian businesses increasingly evaluate total cost of ownership, including energy consumption, maintenance requirements, and operational efficiency.

Future Outlook and Recommendations

Market Growth Projections

The Norwegian commercial dishwasher market is projected to continue growing at a steady pace, driven by:

- Expanding tourism and hospitality sector

- Increasing focus on food safety and hygiene

- Growing demand for energy-efficient solutions

- Modernization of existing kitchen facilities

Strategic Recommendations

For Market Leaders: Continue investing in local service capabilities and sustainable technology development while maintaining competitive pricing.

For Emerging Brands: Focus on niche applications and specialized solutions to establish market presence before expanding into broader segments.

For End Users: Prioritize total cost of ownership evaluations, including energy efficiency, maintenance requirements, and service availability when selecting commercial dishwashers.

Conclusion

The Norwegian commercial dishwasher market in 2025 is characterized by strong competition among established global brands, each offering distinct value propositions to serve diverse market segments. Metos maintains its leadership position through comprehensive local support and specialized solutions for Norwegian conditions, while Miele Professional, Hobart, Winterhalter, and Electrolux Professional each contribute unique strengths to serve the market’s varied needs.

Success in this market requires understanding of local requirements, commitment to service excellence, and continuous innovation in energy efficiency and sustainability. As Norway’s hospitality sector continues to grow and modernize, the commercial dishwasher market presents significant opportunities for brands that can deliver superior performance, reliability, and value to their customers.