The commercial dishwasher rental industry represents a significant untapped opportunity for entrepreneurs seeking to enter the equipment leasing market. Based on extensive market analysis and operational experience in the foodservice equipment sector, this comprehensive guide provides a practical roadmap for establishing and scaling a successful commercial dishwasher rental business.

Commercial dishwasher rental business concept visualization

Market Opportunity and Industry Analysis

Growing Market Demand

The global commercial dishwasher market was valued at approximately $3.5 billion in 2023 and is projected to reach $4.8 billion by 2032, representing a compound annual growth rate of 3.4%. Meanwhile, the broader catering services market shows even stronger growth, expanding from $154.71 billion in 2024 to an estimated $229.92 billion by 2033. This parallel growth in both equipment demand and foodservice operations creates an ideal environment for rental businesses.

The equipment rental industry itself has experienced remarkable expansion, outpacing even the construction sector in recent years. This trend reflects businesses’ increasing preference for operational flexibility over capital-intensive purchases, particularly among small and medium-sized enterprises. The COVID-19 pandemic further accelerated this shift, as restaurants and catering companies sought to minimize fixed costs while maintaining operational capability.

Target Market Analysis

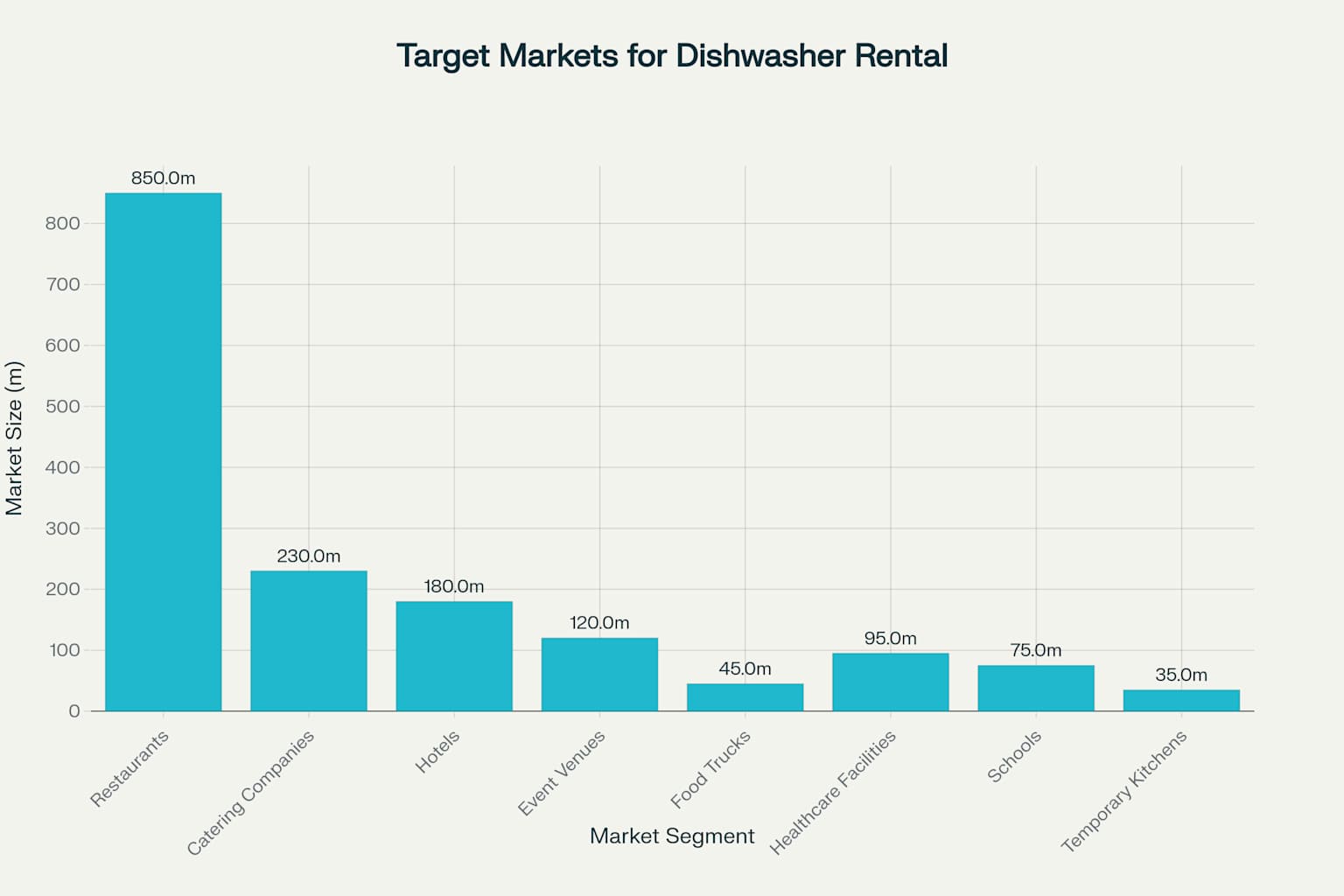

The commercial dishwasher rental market encompasses diverse customer segments, each with distinct needs and rental patterns. Restaurants represent the largest opportunity, with a market size of approximately 850 million, followed by catering companies at 230 million and hotels at 180 million.

Target market size analysis for commercial dishwasher rental business

Understanding customer behavior patterns reveals that different segments have varying rental duration preferences and price sensitivities. Restaurants typically maintain equipment for 18 months on average, while healthcare facilities and schools often require longer-term arrangements extending to 36 months. Event venues and temporary kitchens represent the shortest-term rental market, often requiring equipment for just 2-3 months.

Equipment Types and Return on Investment Analysis

Commercial Dishwasher Categories

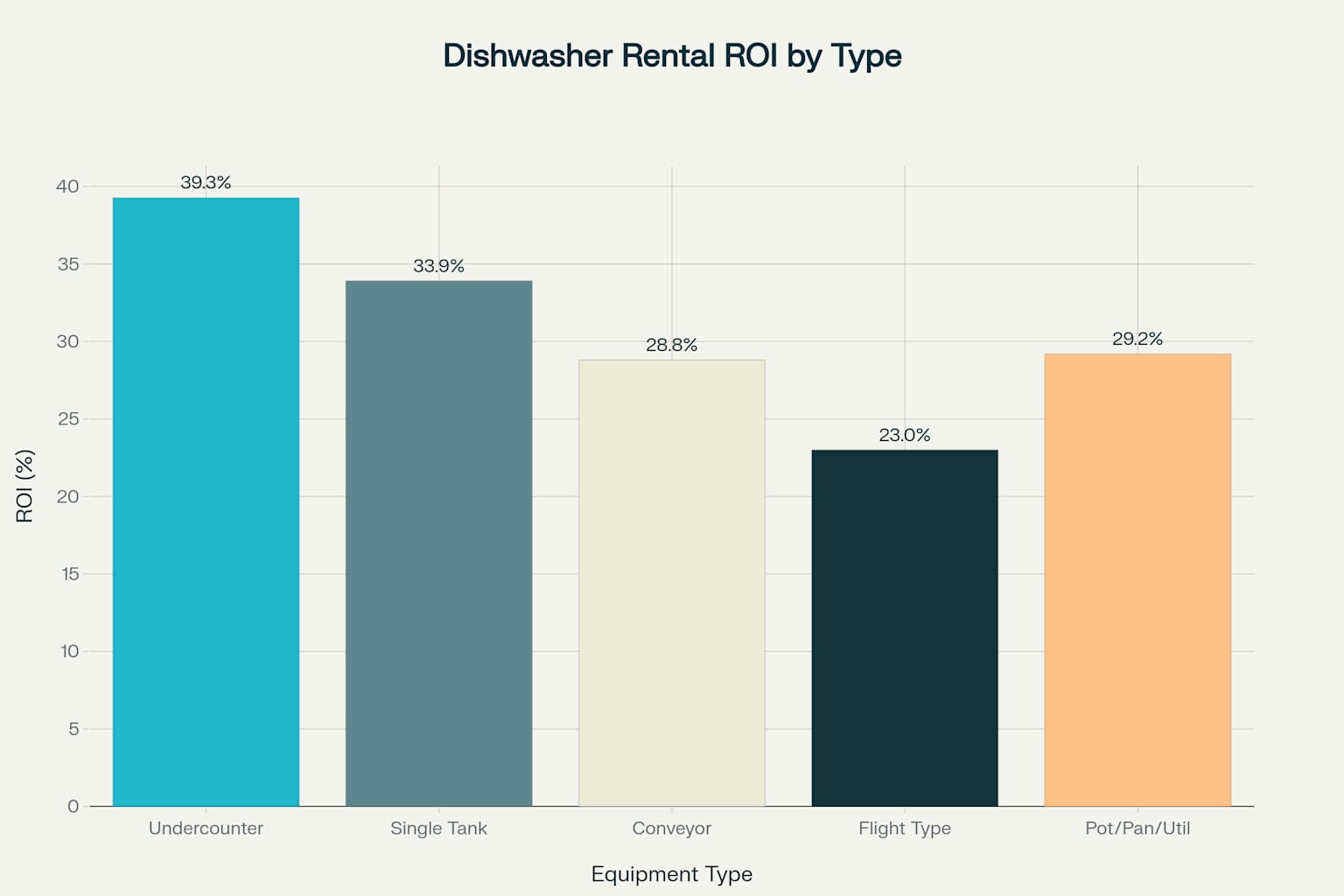

Commercial dishwashers fall into five primary categories, each serving specific market needs and offering different profitability profiles. Undercounter dishwashers target small restaurants and cafes, with purchase prices ranging from $3,000 to $8,000 and monthly rental rates between $110 and $250. These units offer the highest return on investment at 39.27% annually due to their lower acquisition costs and strong demand from small establishments.

Single tank door machines serve medium-sized restaurants with purchase prices from $8,000 to $15,000 and monthly rentals of $200 to $450, generating a 33.91% ROI. Conveyor dishwashers cater to large restaurants and institutions, commanding higher rental rates of $400 to $800 monthly but requiring substantial initial investments of $15,000 to $35,000. Flight type machines represent the premium segment for industrial kitchens, with purchase prices reaching $40,000 to $80,000 and monthly rentals of $800 to $1,500.

ROI analysis for different commercial dishwasher types in rental business model

Energy Efficiency and Operational Standards

Modern commercial dishwashers must meet strict energy and water efficiency requirements established by Energy Star certification programs. Low-temperature undercounter units must consume no more than 1.19 gallons per rack and maintain idle energy rates below 0.25 kW. High-temperature conveyor machines face more stringent requirements, with water consumption limits of 0.54 gallons per rack for multiple tank systems.

These efficiency standards directly impact rental profitability, as customers increasingly prioritize operational cost savings. Energy Star certified equipment commands premium rental rates while reducing customer utility expenses, creating a competitive advantage in the marketplace.

Business Models and Pricing Strategies

Rental Model Variations

Successful commercial dishwasher rental businesses employ multiple revenue models to maximize market penetration and profitability. Long-term rentals represent the most stable segment, capturing 40% of the market with 85% customer retention rates and 28% profit margins. Short-term rentals offer higher profit margins at 35% but lower retention at 60%.

Service package models combine equipment rental with maintenance, chemicals, and technical support, achieving the highest profit margins at 45% while maintaining 90% customer retention. Emergency rental services serve restaurants facing equipment failures, commanding premium rates with 55% margins but representing only 8% of the total market.

Pricing Structure Development

Effective pricing strategies balance market competitiveness with profit optimization. Industry analysis reveals that undercounter units typically rent for $110-250 monthly, while larger conveyor systems command $400-800 per month. Rent-to-own programs offer customers eventual ownership while generating steady cash flow, though they yield lower profit margins at 22%.

Chemical and maintenance packages provide additional revenue streams, with detergent costs averaging $24 per gallon and usage varying by machine type. Comprehensive service packages including 24-hour maintenance, chemical supplies, and emergency support justify premium pricing while reducing customer total cost of ownership.

Operational Requirements and Cost Structure

Startup Capital and Infrastructure

Establishing a commercial dishwasher rental business requires initial capital ranging from $75,000 to $150,000, depending on fleet size and market scope. The initial equipment investment should focus on 5-10 undercounter units to test market demand while minimizing financial exposure. A warehouse facility of at least 2,000 square feet provides adequate space for inventory storage, maintenance operations, and administrative functions.

Transportation infrastructure represents a critical operational component, requiring either dedicated delivery vehicles or partnerships with specialized equipment movers. Professional installation and pickup services differentiate successful rental businesses from simple equipment leasing operations.

Operating Cost Analysis

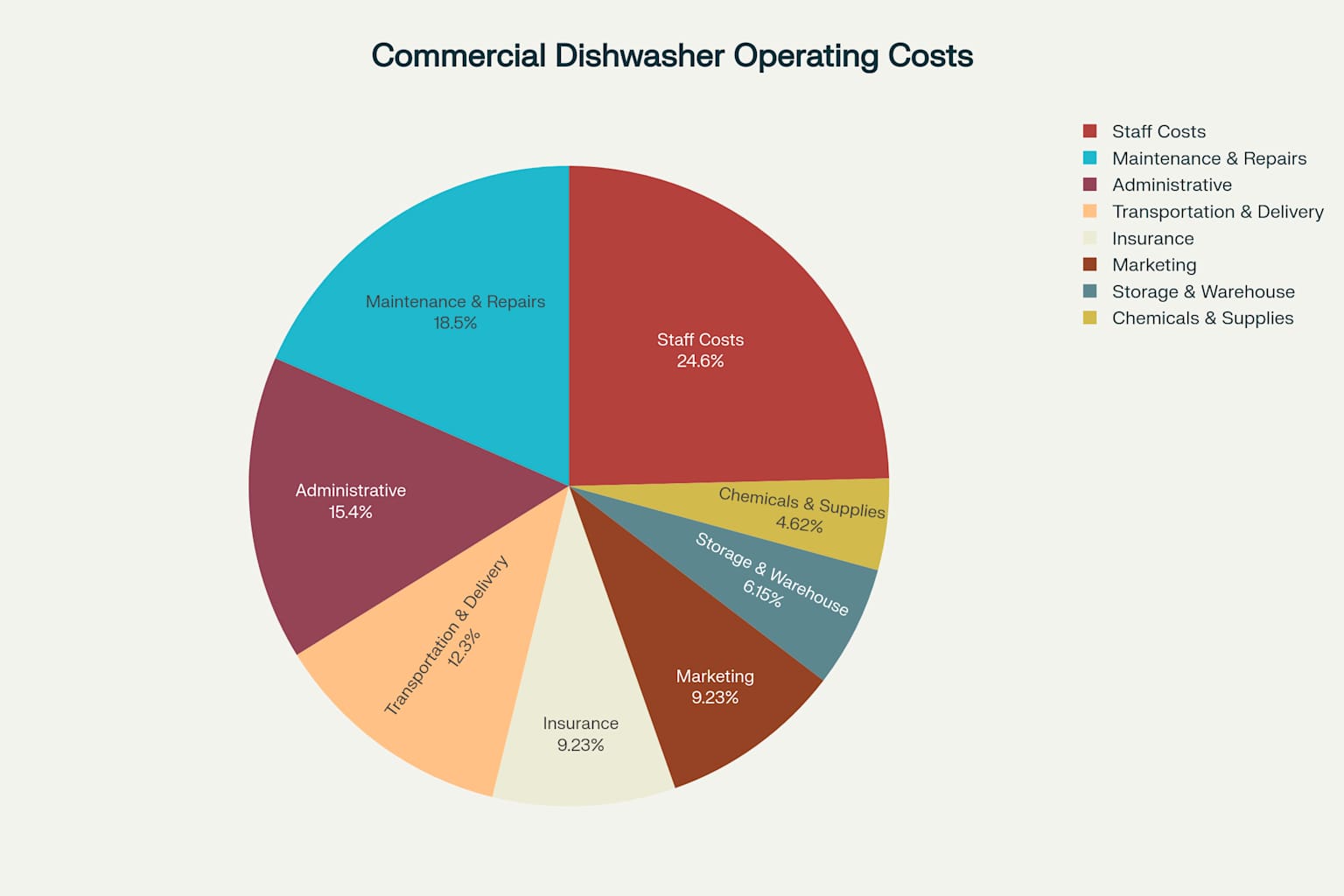

Operating expenses for commercial dishwasher rental businesses follow predictable patterns across multiple cost categories. Staff costs represent the largest expense at 16% of revenue, reflecting the labor-intensive nature of delivery, installation, and maintenance services. Maintenance and repairs account for 12% of revenue, emphasizing the importance of preventive maintenance programs and technical expertise.

Operating cost breakdown for commercial dishwasher rental business

Transportation and delivery costs consume 8% of revenue, while insurance requirements add another 6%. Storage and warehouse expenses typically represent 4% of revenue, with chemicals and supplies contributing an additional 3%. Marketing investments averaging 6% of revenue support customer acquisition and retention efforts.

Customer Acquisition and Marketing Strategies

Target Customer Identification

Successful customer acquisition requires focused targeting of specific market segments with tailored value propositions. Small to medium restaurants with 20-100 seats represent the primary target market, as they lack capital for equipment purchases but require professional dishwashing capability. Catering companies offer attractive short-term rental opportunities during peak event seasons.

Event venues and temporary kitchen operations provide high-margin emergency rental opportunities, though these customers typically require immediate availability and premium service levels. Healthcare facilities and schools represent longer-term contracts with stable payment patterns but more stringent hygiene requirements.

Sales Channel Development

Direct sales efforts should focus on restaurant association meetings, foodservice trade shows, and targeted outreach to newly opened establishments. Partnership development with kitchen equipment dealers creates referral opportunities while providing customers with comprehensive equipment solutions. Online presence through professional websites and social media platforms supports lead generation and brand credibility.

Promotional pricing for first-time customers helps overcome initial resistance while demonstrating service quality. Seasonal marketing campaigns targeting peak catering periods and restaurant opening seasons maximize customer acquisition timing.

Financial Projections and Profitability Analysis

Revenue Growth Expectations

Well-executed commercial dishwasher rental businesses typically achieve monthly recurring revenue of $30,000 or more by the twelfth month of operation. Equipment utilization rates of 70% or higher ensure profitable operations, while customer retention rates above 80% support sustainable growth. Average rental durations of 12 months or longer provide stable cash flow and justify customer acquisition investments.

Gross profit margins of 40% represent industry benchmarks for successful operations, achieved through efficient cost management and premium service delivery. Return on investment calculations show that undercounter units generate 39.27% annual returns, while larger equipment offers lower but still attractive returns of 23-33%.

Break-even Analysis and Growth Trajectory

Most commercial dishwasher rental businesses achieve break-even within 8-12 months of operation, assuming adequate initial capitalization and effective marketing execution. The first phase focuses on market establishment with 5-10 units serving local restaurants and catering companies. Expansion phases involve geographic growth and equipment diversity, targeting industrial kitchens and specialized applications.

Long-term profitability depends on maintaining high utilization rates while controlling operating expenses. Successful businesses reinvest profits in fleet expansion and service capability enhancement, capturing larger market share in established territories.

Risk Management and Success Factors

Operational Risk Mitigation

Commercial dishwasher rental businesses face multiple operational risks that require proactive management strategies. Equipment downtime must be minimized through preventive maintenance programs and rapid repair response capabilities. Backup inventory of 20% above active rental fleet ensures availability during peak demand periods.

Customer payment risks require comprehensive credit evaluation and clear contract terms. Insurance coverage must include equipment protection, liability coverage, and business interruption insurance. Diversified customer bases across multiple market segments reduce concentration risks.

Critical Success Factors

Market research and competitive analysis inform pricing strategies and service differentiation. Technical expertise in equipment maintenance and repair ensures customer satisfaction and equipment longevity. Strong vendor relationships provide access to quality equipment and replacement parts at competitive prices.

Customer service excellence, including 24-hour emergency response and professional installation, differentiates successful businesses from competitors. Financial management discipline maintains healthy cash flow and supports strategic growth investments.

The commercial dishwasher rental business represents a compelling opportunity for entrepreneurs with adequate capital and operational expertise. Market growth trends, increasing customer preference for operational flexibility, and attractive return on investment profiles support positive long-term prospects. Success requires careful planning, strategic execution, and commitment to service excellence in a competitive marketplace.