Australia’s household appliance market demonstrates significant regional variations in dishwasher adoption and accessories availability, reflecting diverse economic conditions, housing patterns, and consumer preferences across states and territories. This comprehensive analysis examines market penetration, distribution networks, and aftermarket support across Western Australia, South Australia, Queensland, Victoria, and the Australian Capital Territory, providing insights essential for industry stakeholders and market analysts.

National Market Overview and Growth Trajectory

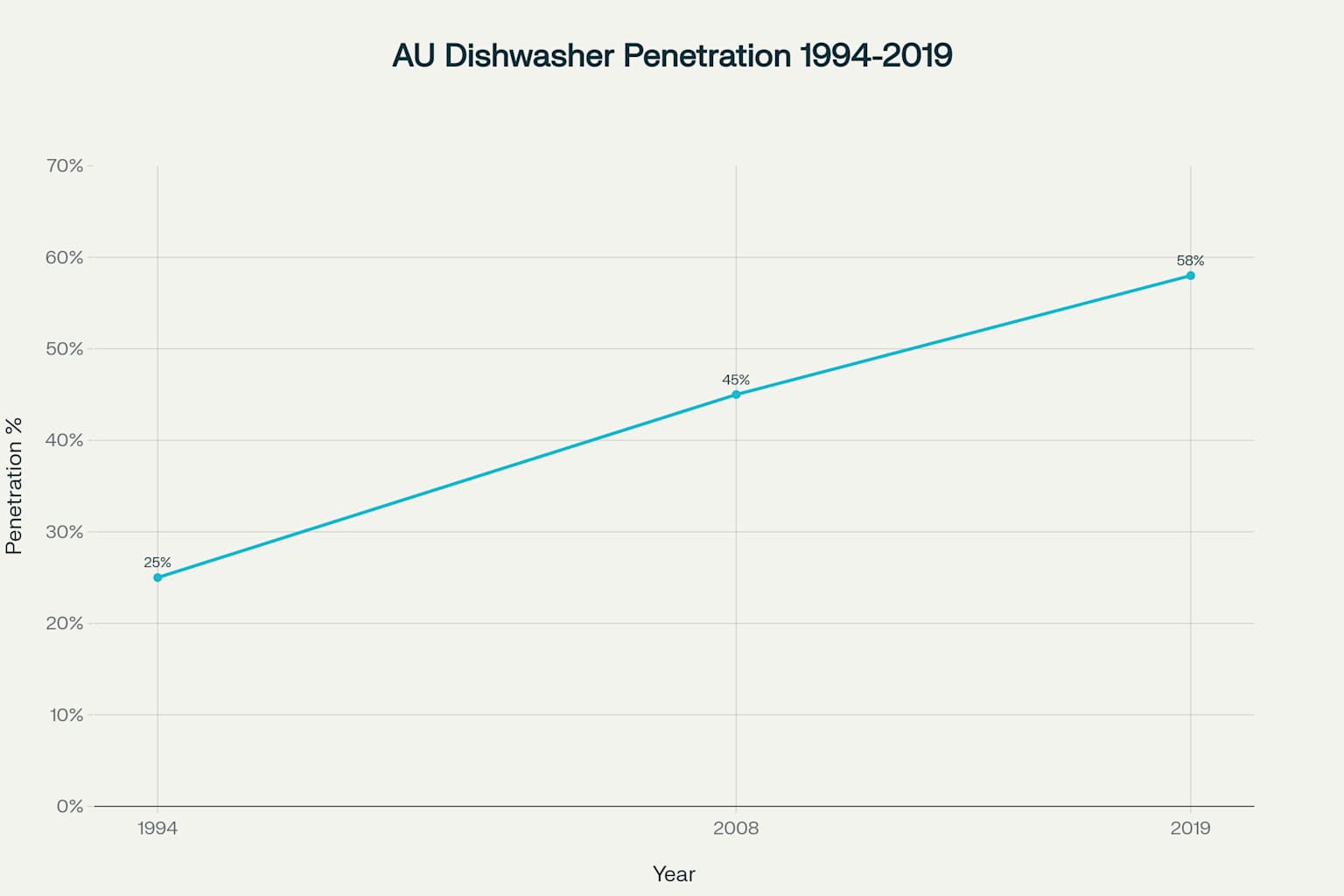

The Australian household appliance market represents a substantial economic sector valued at approximately $12.87 billion in 2023, with dishwashers forming a critical component of this ecosystem. National dishwasher penetration has demonstrated remarkable growth, increasing from 25% in 1994 to 58% by 2019, representing more than a doubling of market adoption over 25 years. This growth trajectory reflects broader socioeconomic trends including rising disposable incomes, changing lifestyle preferences, and increased urbanization across Australia.

Australian dishwasher penetration has more than doubled from 25% in 1994 to 58% in 2019, showing consistent growth over 25 years

Contemporary market analysis reveals that Australian households possess an average of five large appliances, with dishwashers representing one of the fastest-growing categories in recent decades. The market exhibits strong fundamentals with projected annual growth rates of 4.50% through 2030, driven by replacement cycles, new household formations, and technological advancement. Industry data indicates that each Australian household generates approximately $516.59 in annual revenue for the appliance sector, with major appliances accounting for the largest market segment.

Regional Penetration Analysis

Australian Capital Territory: Market Leadership

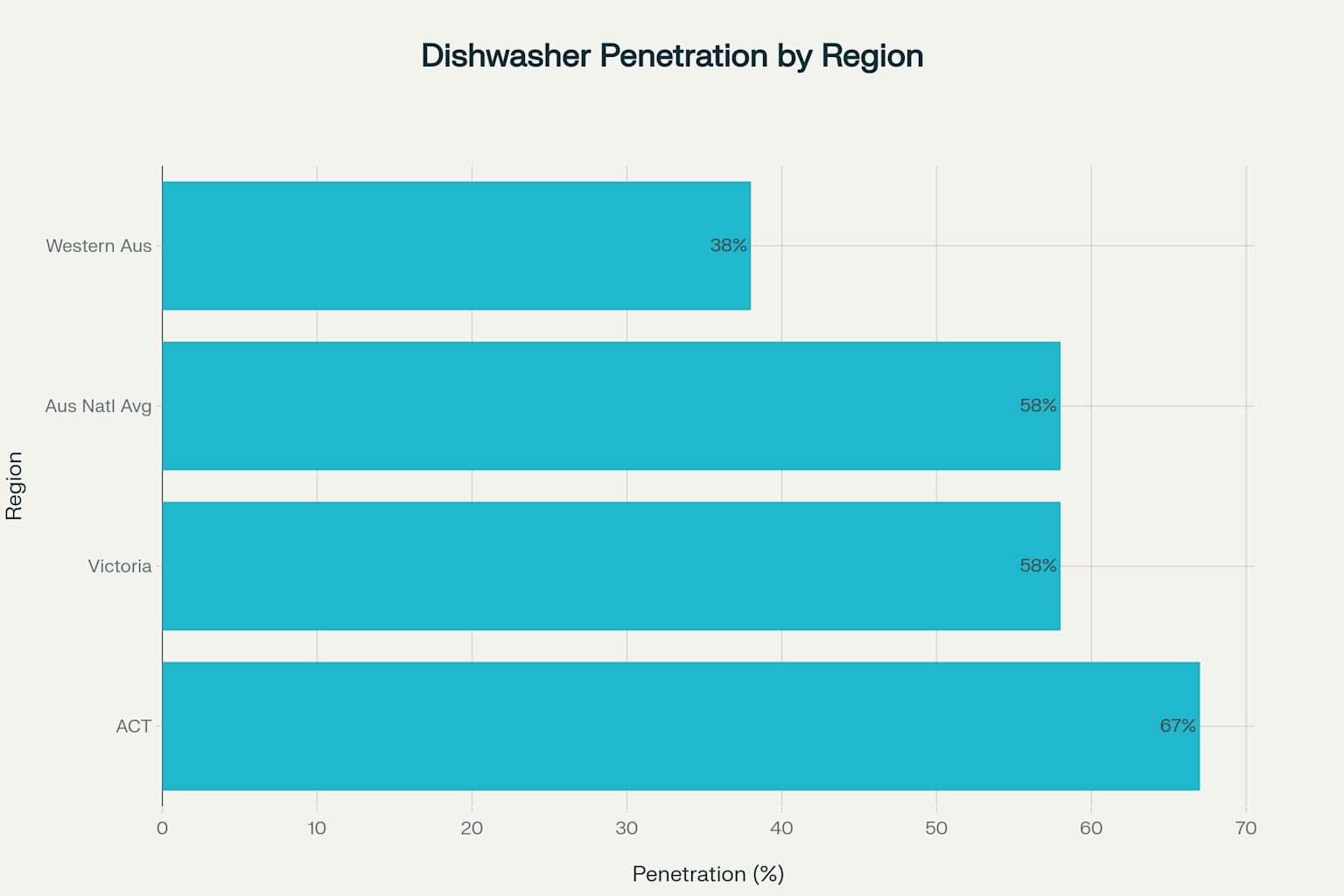

The Australian Capital Territory demonstrates the highest dishwasher penetration rate among Australian regions at 67%, reflecting the territory’s unique demographic profile and economic characteristics. This premium market position correlates strongly with the ACT’s elevated household income levels, higher education rates, and concentrated urban housing development patterns. The territory’s public service employment base contributes to stable, above-average incomes that support discretionary appliance purchases.

ACT households exhibit sophisticated consumer preferences, with strong demand for energy-efficient and connected appliance technologies. The territory’s compact geographic footprint facilitates efficient distribution networks and service coverage, contributing to robust accessories availability and aftermarket support. Local retailers report consistently strong demand for premium dishwasher models and related accessories, supported by the territory’s environmentally conscious consumer base.

Dishwasher penetration rates across Australian regions showing significant variation, with ACT leading at 67% and Western Australia at 38%

Victoria: Strong Market Penetration

Victoria maintains solid dishwasher penetration at 58%, aligning closely with national averages while reflecting the state’s diverse economic landscape. The state’s penetration rates vary significantly between metropolitan Melbourne and regional areas, with urban centers demonstrating higher adoption rates consistent with population density and income patterns. Victoria’s established manufacturing base and distribution infrastructure support comprehensive market coverage across both metropolitan and regional markets.

The state’s housing market characteristics significantly influence dishwasher adoption, with newer developments and apartment complexes increasingly featuring built-in dishwasher installations. Victorian consumers demonstrate strong preferences for established brands including Bosch, Fisher & Paykel, and Electrolux, reflecting the state’s emphasis on quality and reliability. Regional distribution networks extend throughout the state, though rural areas may experience longer lead times for specialized parts and service.

Queensland: Growing Market Dynamics

Queensland’s dishwasher market reflects the state’s rapid population growth and evolving demographic composition, with penetration rates gradually approaching national averages. The state’s subtropical climate and outdoor lifestyle traditionally emphasized different appliance priorities, though changing urbanization patterns drive increased dishwasher adoption. Brisbane and Gold Coast metropolitan areas demonstrate higher penetration rates compared to regional Queensland, reflecting income differentials and housing characteristics.

Solar energy adoption in Queensland, reaching 28% of households by 2019, influences appliance purchasing decisions with consumers increasingly prioritizing energy-efficient dishwasher models. The state’s growing population, particularly in Southeast Queensland, creates expanding market opportunities for both primary sales and aftermarket accessories. Distribution networks concentrate along the coastal corridor, with inland regions experiencing more limited immediate parts availability.

Western Australia: Emerging Market Potential

Western Australia exhibits the lowest regional dishwasher penetration at 38%, presenting significant growth opportunities within Australia’s appliance market. This lower penetration reflects historical housing patterns, climate considerations, and distance-related distribution challenges that have traditionally characterized the state’s appliance market. However, Perth’s continued urban development and rising household incomes indicate strong potential for market expansion.

The state’s mining-driven economy creates distinct consumer segments with varying appliance preferences and purchasing power. Remote mining communities often prefer portable or compact dishwasher solutions due to housing constraints and temporary accommodation arrangements. Perth’s metropolitan area demonstrates higher penetration rates approaching national averages, while regional and remote areas maintain significantly lower adoption rates.

South Australia: Stable Market Foundations

South Australia maintains moderate dishwasher penetration rates reflecting the state’s established residential base and stable economic conditions. Adelaide’s metropolitan area drives state penetration levels, with established suburban communities increasingly retrofitting dishwashers during kitchen renovations. The state’s energy efficiency programs, including the Retailer Energy Productivity Scheme (REPS), incentivize high-efficiency appliance purchases including dishwashers.

Regional South Australia demonstrates varied penetration patterns, with wine-growing regions and established farming communities showing different adoption rates based on water usage considerations and lifestyle factors. The state’s appliance retail sector benefits from established distribution networks and competitive pricing, supporting steady market growth.

Accessories and Spare Parts Market Infrastructure

Distribution Network Analysis

Australia’s dishwasher accessories and spare parts market operates through a sophisticated multi-channel distribution system encompassing manufacturer-authorized dealers, independent retailers, and online platforms. Major brands including Bosch, Electrolux, Fisher & Paykel, and Siemens maintain dedicated parts distribution networks across all five regions, though availability timelines vary significantly between metropolitan and regional areas.

Specialist appliance parts retailers such as Doug Smith Spares and SOS Parts have established themselves as key market players, offering comprehensive inventories spanning multiple brands and model generations. These distributors typically maintain 366-554 different dishwasher parts categories, including control panels, pumps, filters, and heating elements. The online channel has become increasingly important, with 22.7% of appliance-related purchases expected to occur online by 2025.

Common Parts and Pricing Structure

Australian dishwasher repair and maintenance generates substantial aftermarket revenue, with the domestic appliance repair industry valued at approximately $2.1 billion annually. The most frequently required spare parts include drain pumps ($86-242), control panels ($99-202), heating elements ($35-139), and cutlery baskets ($41-50), reflecting typical wear patterns and component failure rates.

Professional repair services charge between $80-330 per hour for labor, with parts markup typically adding 20% above wholesale prices. Common repair scenarios include exhaust problems ($240-1,000), filter issues ($50-360), and electrical problems ($150-310), with median repair costs around $352. These pricing structures remain relatively consistent across regions, though remote areas may incur additional freight and travel charges.

Brand-Specific Availability Patterns

Premium European brands like Bosch, Miele, and Siemens typically maintain superior parts availability through authorized dealer networks, with parts often available within 3-5 business days in metropolitan areas. Australian and Asian manufacturers including Fisher & Paykel, Electrolux, and LG demonstrate strong local parts support, leveraging domestic distribution infrastructure. Emerging brands and budget models may experience longer parts lead times, particularly for specialized electronic components.

The aftermarket has developed robust universal parts solutions for common components like cutlery baskets, filters, and basic hardware items. However, electronic control systems, proprietary sensors, and brand-specific aesthetic components typically require original manufacturer parts, potentially extending repair timelines in regional areas.

Consumer Behavior and Market Dynamics

Purchase Decision Factors

Australian consumers demonstrate increasing sophistication in dishwasher selection, with energy efficiency ratings, water consumption, and smart connectivity features emerging as key decision criteria. The mandatory energy star rating system influences purchase decisions, with consumers increasingly prioritizing high-efficiency models to reduce utility costs. Price sensitivity varies significantly by region, with premium markets like the ACT and metropolitan Victoria showing greater willingness to invest in advanced features.

Installation requirements significantly influence purchase decisions, particularly in older homes requiring plumbing modifications or electrical upgrades. Consumers increasingly expect comprehensive service packages including delivery, installation, and haul-away services, creating additional revenue opportunities for retailers. Extended warranty uptake remains strong, reflecting consumer concerns about repair costs and parts availability.

Replacement and Upgrade Cycles

Industry analysis indicates that dishwashers typically require replacement every 10-15 years, though technological advancement and changing consumer expectations may accelerate replacement cycles. The repair-versus-replace decision point typically occurs when repair costs exceed 50% of replacement value, with consumers increasingly choosing replacement for units over seven years old. This trend reflects both declining repair economics and the appeal of improved efficiency and features in newer models.

Professional repair statistics indicate that washing machines experience the highest breakdown rates at 49.9%, followed by refrigerators at 41.6%, suggesting that dishwashers maintain relatively strong reliability compared to other major appliances. However, the complexity of modern dishwashers with electronic controls and sensors has increased repair complexity and costs.

Industry Structure and Competitive Landscape

Major Market Players

The Australian dishwasher market features intense competition among multinational manufacturers and local distributors. Samsung Electronics Australia, Electrolux Home Products, and Fisher & Paykel Australia represent the largest wholesale market players, with combined market leadership driving pricing and availability standards. These companies maintain extensive distribution networks and authorized service centers across all five regions.

Independent retailers and specialist appliance stores play crucial roles in regional markets, often providing personalized service and local expertise that large chains cannot match. BrandSource membership programs enable independent retailers to access competitive pricing and marketing support while maintaining local market presence. Online retailers increasingly compete with traditional channels, though complex installation requirements maintain the importance of local service capabilities.

Service and Support Infrastructure

Professional appliance service networks vary significantly between metropolitan and regional areas, with major cities maintaining multiple authorized service centers while remote regions may depend on traveling technicians. Melbourne Digital Television Services leads the domestic appliance repair market with 31.2% market share, followed by Master Appliance Service at 16.7%. These service providers typically maintain broad brand coverage and parts inventory to support diverse consumer needs.

Rural and remote area service provision remains challenging, with longer response times and higher service costs reflecting geographic realities. Some regions rely on multi-skilled technicians serving multiple appliance categories, while others may require parts ordering and return visits for complex repairs. The decline in appliance repair businesses, with industry revenue falling at 0.2% annually, reflects consumer preference for replacement over repair.

Regional Infrastructure and Logistics Considerations

Distribution Challenges

Australia’s vast geography creates distinct logistics challenges for dishwasher and parts distribution, particularly affecting Western Australia and regional Queensland. Perth’s isolation from eastern manufacturing centers results in longer lead times and higher freight costs, influencing both retail pricing and parts availability. Similarly, regional Queensland’s dispersed population centers require complex distribution networks to ensure adequate market coverage.

The concentration of manufacturing and warehousing facilities in Melbourne and Sydney creates natural advantages for Victoria and New South Wales, with flow-on benefits for the ACT. South Australia benefits from its central location for cross-country distribution, though its smaller market size may limit inventory depth at regional locations. Freight costs for bulky dishwasher units significantly impact pricing in remote areas, sometimes adding 10-15% to retail prices.

Technology and Smart Home Integration

The emergence of smart home technologies creates new market dynamics across all regions, with connected dishwashers gaining market share particularly in high-income areas. Australian consumers demonstrate growing interest in energy monitoring, remote operation, and integration with solar power systems. These technological trends favor regions with robust internet infrastructure and tech-savvy consumer bases.

Smart appliance adoption correlates strongly with urban density and household income, creating distinct regional adoption patterns. The ACT and metropolitan Victoria lead in smart appliance penetration, while rural areas maintain preference for traditional models due to connectivity limitations and cost considerations. This technological divide influences parts complexity and service requirements across regions.

Market Challenges and Opportunities

Regulatory and Environmental Factors

Australian appliance markets face increasing regulatory complexity around energy efficiency, water usage, and end-of-life recycling requirements. The phase-out of certain refrigerant types and evolving energy standards require ongoing product development and may accelerate replacement cycles. Regional variations in water quality and hardness affect dishwasher performance and maintenance requirements, influencing consumer satisfaction and brand preferences.

Right-to-repair legislation developments in Europe and North America may influence Australian market dynamics, potentially improving parts availability and extending appliance lifespans. Consumer awareness of repair rights under Australian Consumer Law remains limited, creating opportunities for improved consumer education and service transparency.

Economic and Demographic Trends

Australia’s aging population creates both challenges and opportunities for the dishwasher market, with accessibility features becoming increasingly important. Urban densification trends favor compact and built-in dishwasher solutions, while rural lifestyle preferences maintain demand for traditional formats. Rising construction costs and apartment living trends influence installation requirements and product specifications.

Climate change adaptation may affect regional demand patterns, with water-efficient models gaining importance in drought-prone areas. Energy cost volatility creates consumer interest in efficient appliances, though upfront cost premiums may limit adoption in price-sensitive markets. Government incentive programs like South Australia’s REPS create regional market opportunities for high-efficiency appliances.

Conclusions and Strategic Implications

The Australian dishwasher market demonstrates significant regional variation in penetration rates, ranging from the ACT’s market-leading 67% to Western Australia’s developing 38% adoption rate. These disparities reflect underlying economic, demographic, and infrastructure differences that create distinct market opportunities and challenges across regions. The national trajectory shows sustained growth potential, with penetration more than doubling over the past 25 years and projected continued expansion.

Accessories and spare parts availability maintains reasonable standards in metropolitan areas through established distribution networks, though regional and remote areas face ongoing challenges with lead times and service costs. The industry’s shift toward online distribution channels offers potential solutions for improving regional market access, though complex installation requirements maintain the importance of local service capabilities.

Strategic success in the Australian dishwasher market requires understanding regional nuances while maintaining operational efficiency across diverse geographic markets. Companies must balance standardized product offerings with region-specific marketing, pricing, and service strategies to capture growth opportunities while managing distribution complexity. The ongoing transition toward smart, efficient appliances creates differentiation opportunities, though adoption rates will likely follow established regional economic patterns.

Future market development depends on addressing infrastructure limitations in underserved regions while capitalizing on urbanization trends and environmental consciousness in established markets. The industry’s ability to maintain competitive repair and parts costs will significantly influence consumer satisfaction and brand loyalty across all regions.