Louisville’s vibrant restaurant scene, with approximately 1,800 establishments serving a population of 770,000, represents a significant and growing market for commercial dishwashing solutions. This analysis examines the current landscape, emerging needs, and strategic solutions for foodservice operators seeking optimal warewashing equipment in the Louisville metropolitan area.

Executive Summary

The Louisville commercial dishwasher market reflects broader industry trends toward energy efficiency, regulatory compliance, and operational optimization. With the city’s restaurant density of 2.34 establishments per 1,000 residents—indicating a robust foodservice sector—annual equipment replacement needs are estimated at 360-540 units based on typical replacement cycles. The post-pandemic recovery has strengthened Louisville’s food scene, creating renewed demand for reliable, efficient dishwashing solutions that support both profitability and health code compliance.

Louisville Restaurant Market Landscape

Market Composition and Growth Drivers

Louisville’s restaurant industry has demonstrated remarkable resilience and growth, particularly following the COVID-19 pandemic. The city’s reputation as an emerging foodie destination, bolstered by bourbon tourism and major events like the Kentucky Derby, has created sustainable demand for diverse dining experiences. Industry analysis reveals several key market drivers:

Tourism and Hospitality Integration: The symbiotic relationship between Louisville’s bourbon industry and restaurant scene creates year-round demand for professional kitchen equipment. Restaurants report increased volume during Derby season, bourbon festivals, and convention center events, necessitating high-capacity dishwashing solutions.

Independent Restaurant Culture: Unlike many markets dominated by chain operations, Louisville’s food scene thrives on independent establishments. This creates unique opportunities for customized dishwashing solutions tailored to specific operational needs rather than standardized corporate specifications.

Post-Pandemic Adaptation: Restaurant operators have learned to optimize operations for both dine-in and takeout service models. This operational flexibility requires dishwashing equipment capable of handling diverse service volumes and container types efficiently.

Labor Market Considerations

The restaurant industry’s ongoing labor challenges have made equipment reliability and ease of operation critical factors in purchasing decisions. Operators consistently report that dishwashing positions are among the most difficult to fill and retain. This reality drives demand for automated solutions that reduce labor dependency while maintaining sanitation standards.

Commercial Dishwasher Types and Applications

Equipment Categories and Operational Characteristics

The commercial dishwasher market offers distinct equipment categories, each serving specific operational requirements and volume demands. Understanding these distinctions is crucial for making informed purchasing decisions that align with business needs and growth projections.

Undercounter Dishwashers: These compact units serve establishments with limited space and moderate volume requirements. Typical installations include coffee shops, small cafes, and specialty food retailers. Despite their smaller footprint, modern undercounter units can process 20-40 racks per hour, making them suitable for operations serving 20-50 covers during peak periods.

Door-Type and Hood Dishwashers: Representing the most common choice for mid-volume operations, these units offer the optimal balance of capacity, space efficiency, and operational flexibility. Fast-casual restaurants and full-service establishments with 50-200 seats typically find these units meet their operational demands while fitting within reasonable space constraints.

Conveyor Systems: High-volume operations, including hotel kitchens, hospital food services, and major restaurant chains, require the continuous processing capability of conveyor dishwashers. These systems can handle 200-1,000 racks per hour, supporting operations serving hundreds of covers during peak service periods.

Technology Integration and Automation

Modern commercial dishwashers incorporate advanced technologies that address both operational efficiency and regulatory compliance. Soil sensors automatically adjust wash cycles based on load requirements, optimizing water and energy consumption while ensuring proper cleaning. Digital temperature monitoring systems provide real-time compliance documentation, crucial for health department inspections.

IoT connectivity enables remote monitoring and maintenance scheduling, reducing unexpected downtime. These features are particularly valuable for Louisville restaurant operators who must maintain consistent service during high-demand periods like special events and tourist seasons.

Regulatory Compliance and Health Code Requirements

NSF Standards and FDA Compliance

Commercial dishwashers must meet strict NSF/ANSI Standard 3 requirements, establishing minimum public health and sanitation standards for materials, design, construction, and performance. These standards mandate specific temperature requirements that vary by machine type and sanitization method.

High-temperature sanitizing systems must achieve surface temperatures of 160°F as measured by irreversible registering temperature indicators. This requirement necessitates careful consideration of water heating infrastructure and energy costs. Low-temperature chemical sanitizing systems offer alternative approaches but require precise chemical dispensing and monitoring systems.

Kentucky and Louisville Specific Requirements

Kentucky health department regulations align with FDA Food Code requirements while incorporating state-specific provisions. Louisville Metro Health Department inspections focus particularly on temperature monitoring and documentation systems. Restaurant operators must maintain daily temperature logs and provide immediate access to temperature data during inspections.

The city’s restaurant inspection reports from May 2024 indicate that dishwashing-related violations represent approximately 15% of all health code infractions, making proper equipment selection and maintenance critical for operational continuity.

Energy Efficiency and Operating Cost Analysis

ENERGY STAR Benefits and ROI

Energy efficiency has become a primary consideration for Louisville restaurant operators facing rising utility costs and environmental responsibility expectations. ENERGY STAR certified commercial dishwashers demonstrate significant operational advantages over standard models.

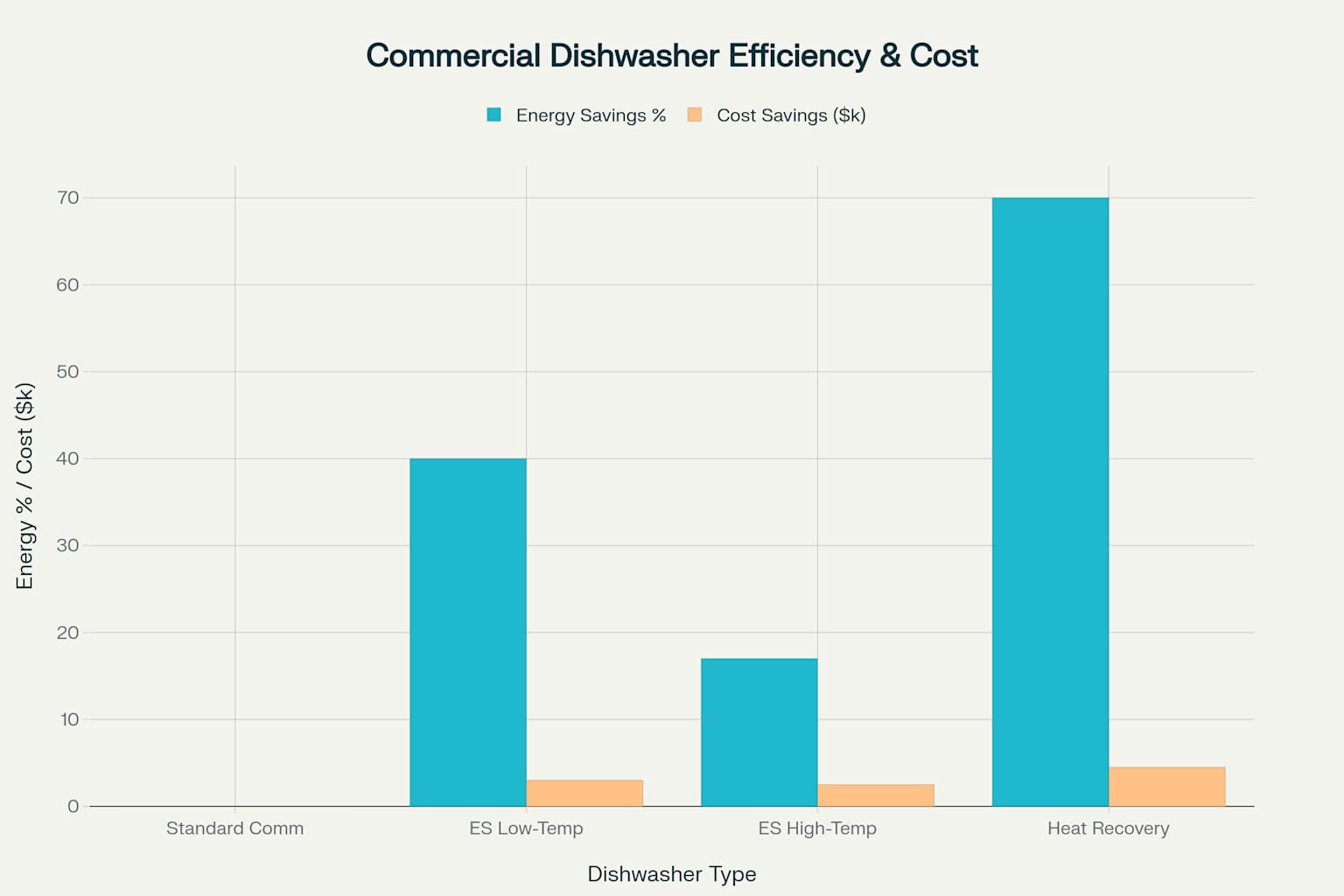

Low-temperature ENERGY STAR models achieve 40% reductions in both energy and water consumption compared to conventional units, translating to average annual savings of $3,000 per unit. High-temperature ENERGY STAR models provide 17% energy savings and 40% water savings, resulting in $2,500 annual cost reductions.

Energy efficiency and annual cost savings comparison across different commercial dishwasher technologies, showing significant benefits of ENERGY STAR and heat recovery models

Heat recovery systems represent the most advanced efficiency technology, capturing waste heat from rinse water to preheat incoming fresh water. These systems can achieve 70% energy savings and annual cost reductions exceeding $4,500, making them particularly attractive for high-volume operations despite higher initial investment requirements.

Utility Incentive Programs

Louisville Gas & Electric offers commercial customers various energy efficiency incentives that can offset equipment upgrade costs. The utility’s Custom Incentive Program provides rebates for high-efficiency commercial dishwashers that exceed standard efficiency levels. Additionally, the city’s Energy Project Assessment District (EPAD) program helps finance energy efficiency improvements through property tax assessments.

Financing Solutions and Local Support Programs

Traditional Financing Options

Commercial dishwasher financing encompasses various approaches tailored to different business situations and credit profiles. Equipment financing loans, typically ranging from $3,000 to $250,000, use the purchased equipment as collateral, often requiring minimal down payments and offering competitive interest rates between 6-15%.

SBA 7(a) loans provide access to larger funding amounts for major expansion projects, with loan amounts up to $5,000,000 and terms extending to 25 years. While approval processes take 30-90 days, these loans offer attractive interest rates for qualified borrowers.

Louisville-Specific Programs

The Metropolitan Business Development Corporation (METCO) offers specialized loan programs for Jefferson County businesses, providing up to $680,000 in funding specifically for small business equipment purchases. These loans feature below-market interest rates ranging from 4-8% and flexible terms up to 20 years.

Downtown Louisville businesses benefit from additional resources through the Louisville Downtown Partnership’s storefront loan program, offering up to $50,000 in gap financing at rates as low as 3-6%. This program specifically targets businesses investing in street-level improvements, including kitchen equipment upgrades.

The city’s Business Assistance Program provides tax rebates for businesses locating or expanding within Louisville, with incentives potentially exceeding $50,000 for qualifying projects. Recent program modifications allow administrative approval for incentives under $50,000, streamlining the application process for equipment purchases.

Equipment Sizing and Selection Guidelines

Capacity Planning Methodology

Proper dishwasher sizing requires careful analysis of peak volume requirements, service style, and operational constraints. The relationship between dining capacity and dishwashing needs varies significantly based on service model, menu complexity, and operational efficiency.

Small cafes and coffee shops typically require 0.8-1.2 racks per seat during peak periods, making undercounter units suitable for operations with 20-50 seats. Fast-casual operations generate higher dish volumes per seat due to disposable alternatives and rapid turnover, necessitating 40-100 racks per hour capacity.

Full-service restaurants present more complex calculations, as extensive tableware, glassware, and cooking utensils create higher volume requirements. Operations serving 100-200 covers typically need 75-200 racks per hour capacity, often requiring door-type or small conveyor systems.

Space and Infrastructure Considerations

Kitchen space constraints significantly influence equipment selection in Louisville’s diverse restaurant landscape. Historic buildings and converted spaces often present unique challenges requiring creative solutions. Undercounter units require only 4-6 square feet of floor space, while multiple tank conveyor systems may need 120-300 square feet including support areas.

Infrastructure requirements include adequate electrical service, hot water capacity, and drainage systems. High-temperature dishwashers require booster heaters that may necessitate electrical upgrades, while low-temperature systems need chemical feed systems and storage areas.

Market Trends and Future Outlook

Industry Growth Projections

The global commercial dishwasher market demonstrates consistent growth, with projections indicating expansion from $12.36 billion in 2024 to $16.76 billion by 2033, representing a compound annual growth rate of 3.4%. This growth reflects increasing foodservice industry activity, heightened sanitation awareness, and energy efficiency requirements.

Global and Asia Pacific commercial dishwasher market size projections showing steady growth driven by foodservice industry expansion and energy efficiency demands

The Asia Pacific market shows even stronger growth at 5.6% CAGR, driven by rapid urbanization and expanding hospitality sectors. While Louisville represents a smaller market segment, local growth trends align with national patterns, particularly in the post-pandemic recovery phase.

Technology Integration Trends

Emerging technologies continue reshaping commercial dishwashing applications. IoT integration enables predictive maintenance and remote monitoring, reducing downtime and optimizing performance. Advanced water filtration systems extend equipment life while improving wash quality.

Sustainability initiatives drive development of heat recovery systems and water recycling technologies. Restaurant operators increasingly view dishwashing equipment as integrated components of broader sustainability programs, influencing purchasing decisions beyond simple cost considerations.

Recommendations and Strategic Implementation

Equipment Selection Framework

Louisville restaurant operators should prioritize equipment selection based on comprehensive operational analysis rather than initial cost considerations alone. The total cost of ownership, including energy consumption, maintenance requirements, and labor efficiency, typically exceeds initial purchase prices within three to five years.

For new establishments, investing in appropriately sized, energy-efficient equipment provides long-term operational advantages and regulatory compliance assurance. Existing operations should evaluate replacement opportunities based on repair costs, efficiency improvements, and capacity requirements.

Financing Strategy Optimization

Local financing programs offer significant advantages for Louisville businesses, particularly the METCO loan program’s favorable terms and community focus. Restaurant operators should explore these local options before pursuing traditional commercial financing, as rate differences can create substantial savings over loan terms.

Energy efficiency incentives from Louisville Gas & Electric can offset upgrade costs, making premium equipment selections more financially attractive. Combining utility rebates with local loan programs often creates optimal financing packages for equipment investments.

Implementation Timeline Considerations

Restaurant equipment purchases require careful timing to minimize operational disruption. Installation during slower seasonal periods or planned closure intervals reduces revenue impact. Louisville’s tourism patterns suggest January through March as optimal timing for major equipment installations, avoiding Derby season and summer tourism peaks.

The current commercial dishwasher market in Louisville represents significant opportunities for operators willing to invest in appropriate technology and efficiency improvements. Success requires matching equipment capabilities to operational requirements while leveraging available financing and incentive programs to optimize investment returns. As the city’s restaurant scene continues growing and evolving, those who make strategic equipment investments today will be best positioned for long-term success.