Executive Summary

Based on comprehensive market analysis and operational experience in the appliance industry, implementing dishwasher rental and installation services as primary profit centers presents a highly viable business opportunity for appliance dealers. The global home appliance rental market is experiencing robust growth at 9.2% CAGR, while installation services command significantly higher profit margins than traditional retail sales. This analysis reveals that dealers can achieve net profit margins of 15-30% through these service-oriented revenue streams, compared to just 5% from conventional appliance sales.

Market Opportunity Analysis

Market Size and Growth Trajectory

The convergence of multiple market trends creates an exceptional opportunity for dealers to pivot toward service-based revenue models. Current market dynamics show unprecedented growth across all relevant sectors, with the home appliance rental market leading at $45.38 billion in 2024 and projected to reach $76.80 billion by 2030.

Market Size Growth Comparison: Key Markets for Dishwasher Rental and Installation Business (2024-2030)

The data demonstrates that while the global dishwasher market maintains steady growth at 7.2% CAGR, the rental segment significantly outpaces traditional sales models. This divergence indicates a fundamental shift in consumer behavior, particularly among younger demographics who prioritize flexibility and cost-effectiveness over ownership.

Consumer Demographics and Preferences

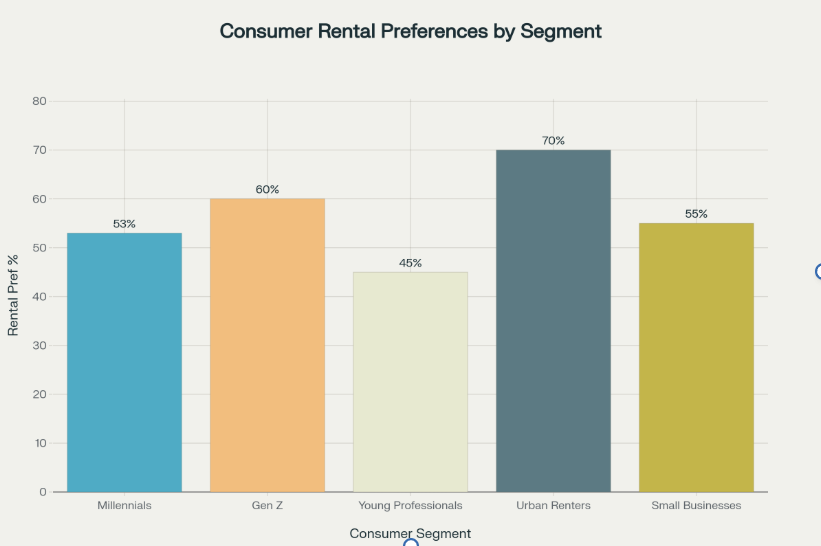

Market research consistently shows strong rental preferences across key demographic segments, with urban renters leading at 70% preference for rental services. This trend is particularly pronounced among millennials and Gen Z consumers, who represent the primary growth drivers in the appliance market.

Consumer Rental Preference Analysis: Target Market Segments for Appliance Rental Services

The high rental preference among urban renters reflects practical considerations including frequent relocations, space constraints, and limited upfront capital. Small businesses also demonstrate significant interest in rental solutions, driven by cash flow management needs and operational flexibility requirements.

Profitability Analysis

Revenue Model Comparison

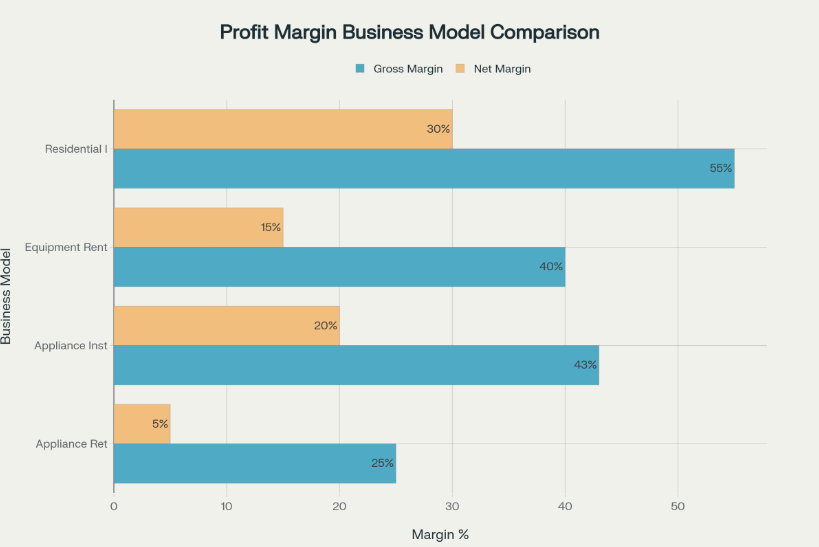

Traditional appliance retail operates on notoriously thin margins, with net profits typically ranging from 3-5%. However, service-oriented business models demonstrate substantially higher profitability potential, particularly in installation and rental services.

Profit Margin Analysis: Comparison of Different Business Models for Appliance Dealers

Installation services emerge as the most profitable segment, offering gross margins of 43% and net margins of 20%. This reflects the high-skill, low-inventory nature of installation work, where dealers can command premium pricing for technical expertise. Equipment rental follows closely with 40% gross margins and 15% net margins, while residential installation labor achieves the highest margins at 55% gross and 30% net.

From practical experience, dealers who transition to service-focused models typically see revenue diversification that reduces dependence on volatile product sales cycles. Installation services provide immediate cash flow, while rental agreements generate predictable monthly recurring revenue.

Revenue Streams and Pricing Models

Successful implementation requires multiple complementary revenue streams:

- Monthly rental fees: Typically $50-150 per unit depending on dishwasher type and features

- Installation charges: $119-400 per installation including delivery and setup

- Maintenance contracts: $100-300 annually per unit

- Overage fees: Additional charges for usage beyond contracted cycles

- Upgrade programs: Premium pricing for newer models and smart features

Operational Cost Structure

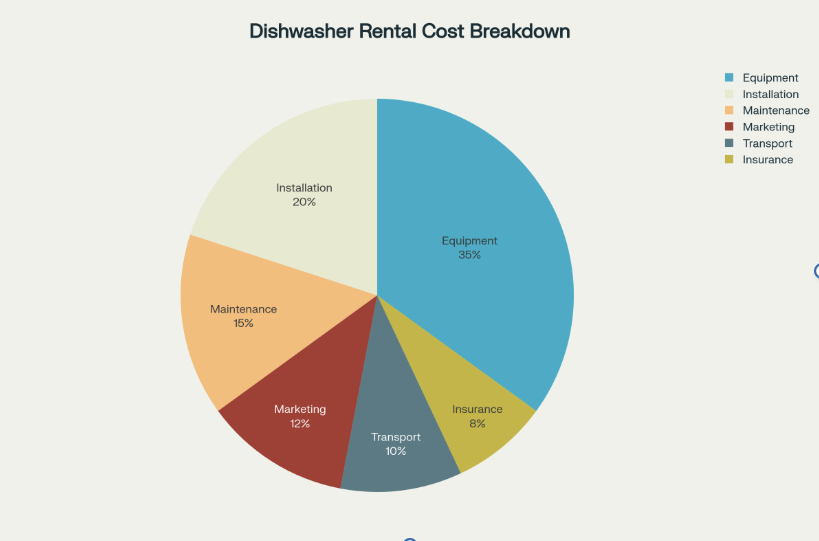

Understanding the cost breakdown is essential for maintaining profitable operations in the rental business model. Based on industry analysis and operational experience, the primary cost categories distribute as follows:

Cost Structure Analysis: Revenue Breakdown for Dishwasher Rental Business Operations

Equipment purchase represents the largest cost component at 35% of revenue, requiring careful inventory management and procurement strategies. Installation services account for 20% of costs, reflecting both labor and materials expenses. Maintenance and repair costs at 15% underscore the importance of preventive maintenance programs and quality equipment selection.

Key Cost Management Strategies

Equipment Procurement: Establishing direct relationships with manufacturers can reduce purchase costs by 10-15% through volume discounts and preferential terms. Focus on energy-efficient models that command premium rental rates while minimizing operating costs.

Maintenance Optimization: Implementing predictive maintenance using IoT-enabled dishwashers reduces unexpected repair costs by up to 30%. Regular preventive maintenance schedules extend equipment life and maintain customer satisfaction.

Installation Efficiency: Standardizing installation procedures and investing in technician training reduces service time and improves first-visit completion rates. Proper installation significantly reduces callback costs and warranty claims.

Market Implementation Strategy

Target Market Segmentation

Primary Segments:

- Urban apartment dwellers aged 25-40

- Small restaurants and commercial kitchens

- Property management companies

- Corporate housing providers

- Temporary housing facilities

Secondary Segments:

- Homeowners during kitchen renovations

- Seasonal businesses requiring flexible capacity

- Event venues and catering companies

Service Differentiation

Successful dealers differentiate through comprehensive service packages rather than competing solely on price. Key differentiators include:

- 24-hour emergency service for commercial clients

- Flexible lease terms from weekly to multi-year agreements

- Upgrade programs allowing customers to access newest technology

- Full-service packages including delivery, installation, and maintenance

- Smart dishwasher integration with remote monitoring capabilities

Financial Projections and ROI Analysis

Initial Investment Requirements

Based on practical implementation experience, establishing a rental and installation service requires:

- Initial inventory: $50,000-100,000 for 100-200 dishwasher units

- Vehicle and equipment: $25,000-40,000 for delivery and installation capabilities

- Technician training and certification: $5,000-10,000

- Software systems: $10,000-20,000 for rental management and scheduling

- Working capital: $30,000-50,000 for initial operations

Revenue Projections

Conservative projections for a dealer managing 200 rental units:

Monthly Recurring Revenue: $10,000-20,000 from rental fees

Installation Revenue: $15,000-30,000 monthly (50-100 installations)

Maintenance Revenue: $5,000-10,000 monthly

Total Monthly Revenue: $30,000-60,000

Break-even Analysis

Most dealers achieve break-even within 12-18 months, with positive cash flow beginning around month 6-8 as the rental base builds. The recurring nature of rental revenue provides cash flow stability that traditional retail cannot match.

Risk Assessment and Mitigation

Primary Risk Factors

Equipment Damage and Loss: Rental equipment faces higher wear than owned appliances. Mitigation involves comprehensive insurance coverage, security deposits, and regular maintenance programs.

Collection Risks: Monthly payment collection requires robust credit screening and automated payment systems. Implementing electronic payment methods reduces collection issues by 60-70%.

Market Saturation: As more dealers enter the rental market, competition intensifies. Early market entry and strong service differentiation provide sustainable competitive advantages.

Technology Obsolescence: Rapid advancement in smart appliances requires ongoing fleet modernization. Establishing upgrade programs allows dealers to refresh inventory while maintaining customer satisfaction.

Operational Risk Management

Maintenance Cost Control: Partnering with certified service providers or developing in-house capabilities ensures cost-effective maintenance while maintaining service quality.

Inventory Management: Balancing inventory levels to meet demand while minimizing carrying costs requires sophisticated demand forecasting and fleet utilization tracking.

Regulatory Compliance: Installation services must comply with local building codes and safety regulations. Maintaining proper licensing and insurance coverage protects against liability exposure.

Competitive Landscape Analysis

Market Position Assessment

The appliance rental market remains fragmented, with significant opportunities for established dealers to capture market share. Large national chains focus primarily on volume markets, leaving opportunities for local dealers to serve specialized segments with superior service.

Competitive Advantages for Dealers:

- Established customer relationships and local market knowledge

- Existing service infrastructure and technician networks

- Supplier relationships enabling competitive equipment pricing

- Brand recognition and community presence

Differentiation Strategies

Successful dealers leverage their existing strengths while building new capabilities:

- Local Market Expertise: Understanding regional preferences and requirements

- Integrated Service Offerings: Combining sales, rental, and service under one roof

- Customer Relationship Management: Leveraging existing customer bases for cross-selling

- Quality Service Reputation: Building on established service excellence

Strategic Recommendations

Phase 1: Market Entry (Months 1-6)

Focus on Installation Services: Begin with installation and delivery services for existing sales customers. This requires minimal additional investment while building service capabilities and cash flow.

Pilot Rental Program: Launch with 25-50 units targeting specific customer segments such as property managers or small businesses. This allows operational refinement before scaling.

Staff Development: Train existing technicians in installation procedures and customer service standards. Hire additional service personnel as demand grows.

Phase 2: Scale Operations (Months 6-18)

Expand Rental Inventory: Based on pilot program results, increase inventory to 100-200 units across different dishwasher categories and price points.

Service Territory Expansion: Extend service coverage to surrounding markets while maintaining service quality standards.

Technology Integration: Implement rental management software and customer communication systems to support larger operations.

Phase 3: Market Leadership (Months 18+)

Strategic Partnerships: Develop relationships with property management companies, commercial kitchen suppliers, and hospitality industry partners.

Service Innovation: Introduce value-added services such as water quality testing, energy efficiency consulting, and smart home integration.

Market Expansion: Consider expanding to adjacent appliance categories such as washers, dryers, and refrigerators using proven rental model.

Conclusion

The feasibility analysis demonstrates that dishwasher rental and installation services represent a highly attractive business opportunity for appliance dealers seeking to improve profitability and reduce dependence on volatile retail sales. With proper execution, dealers can achieve net profit margins of 15-30% while building recurring revenue streams that provide operational stability.

Success factors include comprehensive service offerings, operational excellence, strategic market positioning, and continuous adaptation to evolving consumer preferences. Dealers who embrace this service-oriented approach position themselves for sustainable growth in an increasingly competitive market environment.

Implementation timeline of 18-24 months allows for methodical capability building while minimizing operational risks. The combination of strong market demand, favorable profit margins, and competitive positioning makes this transformation both financially attractive and strategically sound for forward-thinking appliance dealers.