The global dishwasher market, like refrigeration equipment, operates under a complex web of mandatory and voluntary certification schemes that significantly impact market access strategies. Through extensive industry experience and regulatory analysis, this report examines the certification landscape for both commercial and residential dishwashers across major international markets.

Regional Certification Landscape Overview

The certification requirements for dishwashers vary significantly across regions, reflecting different regulatory priorities and market maturity levels. Based on comprehensive analysis of current regulatory frameworks, manufacturers face a diverse array of mandatory and optional certification pathways that directly influence their ability to access key markets.

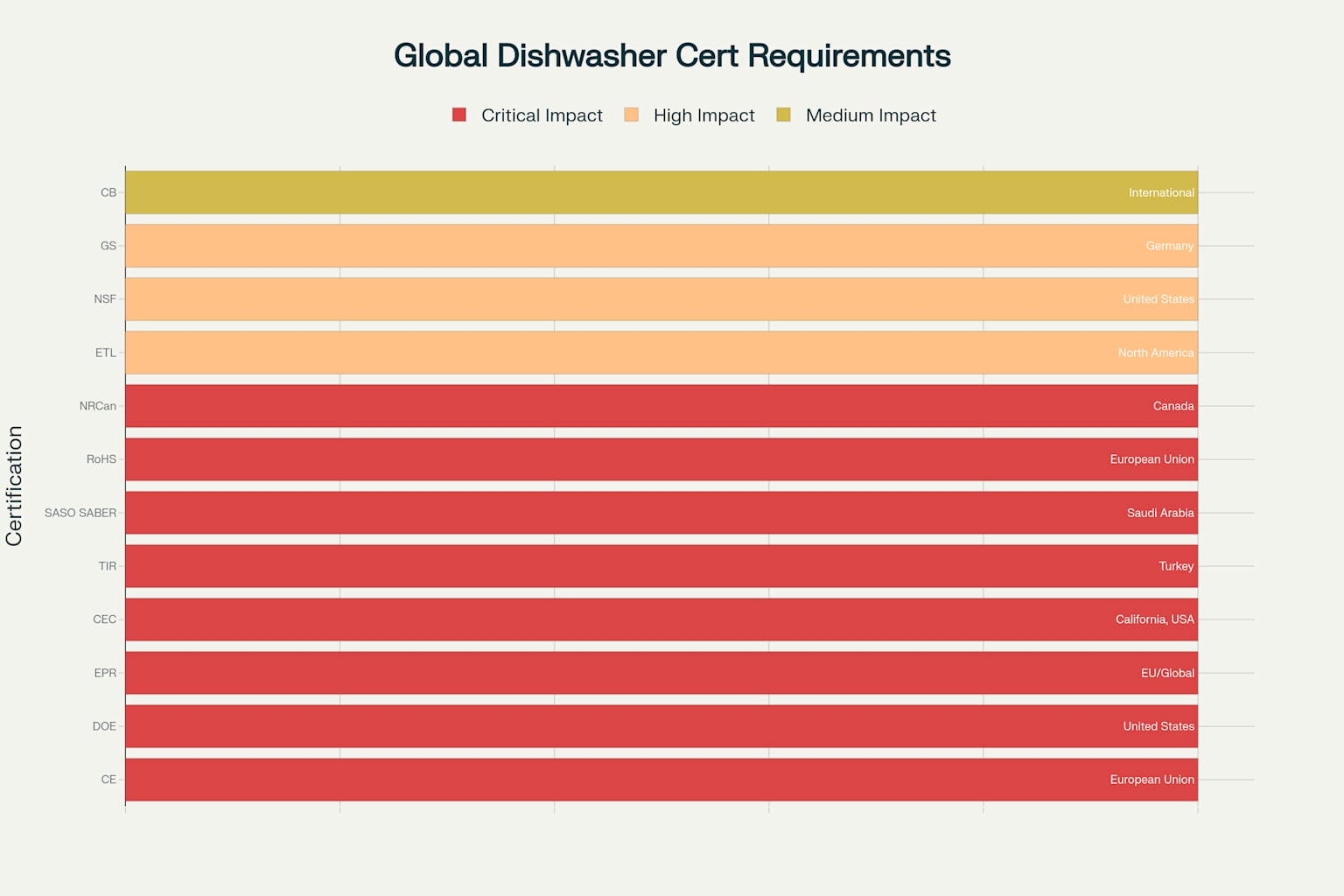

Global Dishwasher Certification Requirements showing market access impact across different regions

The market access impact assessment reveals that nine out of twelve major certification schemes carry critical importance for successful market entry. This regulatory density reflects the increasing focus on energy efficiency, safety, and environmental responsibility in appliance manufacturing.

European Union Market Requirements

Mandatory Certifications

CE Marking represents the cornerstone of EU market access for dishwashers. This comprehensive certification encompasses multiple directives including the Low Voltage Directive (LVD), Electromagnetic Compatibility (EMC) directive, and specific safety standards. Both commercial and residential dishwashers must comply with EN 60335-2-5 for household units and EN 60335-2-58 for commercial equipment.

RoHS Compliance has become increasingly critical following the 2019 expansion to include four additional phthalates. The restriction of hazardous substances directly impacts component selection and manufacturing processes, requiring detailed material declarations and testing protocols.

Extended Producer Responsibility (EPR) obligations now extend across multiple EU member states, mandating manufacturer responsibility for end-of-life product management. This environmental certification requires registration with national producer responsibility organizations and financial contributions to waste management systems.

Market Access Implications

EU certification costs typically range from €1,200 to €1,500 per certification type, with combined timelines spanning 8-12 weeks for standard compliance pathways. The regulatory harmonization across member states provides manufacturers with significant economies of scale once initial compliance is achieved.

North American Certification Framework

United States Requirements

Department of Energy (DOE) Standards mandate energy efficiency compliance for all dishwashers sold in the US market. The 2024 amendments to dishwasher standards require standard-size units to limit consumption to 307 kWh per year and 5.0 gallons per cycle, with enhanced standards taking effect in 2027.

NSF Certification presents a unique requirement structure where commercial dishwashers must achieve NSF/ANSI 3 compliance for sanitation performance, while residential units can optionally pursue NSF/ANSI 184 certification for enhanced sanitization capabilities. This dual-track approach reflects the different operational environments and performance expectations.

ETL Listing provides an alternative safety certification pathway recognized by OSHA, offering manufacturers flexibility in demonstrating compliance with North American safety standards.

California-Specific Requirements

The California Energy Commission (CEC) Title 20 regulations impose additional energy efficiency requirements beyond federal standards. These state-level mandates often preview future federal requirements, making California compliance a strategic indicator of broader market trends.

Canadian Market Standards

Natural Resources Canada (NRCan) energy efficiency regulations closely align with US DOE standards while maintaining separate certification pathways. The 2023 updates to Canadian Energy Efficiency Regulations demonstrate ongoing harmonization efforts with US standards while preserving distinct Canadian requirements.

Middle East and Emerging Markets

Saudi Arabia SABER System

The SASO SABER platform represents a comprehensive digital certification system covering electrical safety, electromagnetic compatibility, and energy efficiency. Implementation of SASO 3029:2023 specifically addresses dishwasher energy performance standards with staged enforcement timelines extending through 2026.

Turkish Standards

Turkish Standards Institution (TSE) certification requirements mandate compliance with both safety and quality standards. The TIR system provides mutual recognition pathways for products already certified to international standards, facilitating market access for globally compliant manufacturers.

International Recognition Schemes

The CB Scheme (Certification Body Scheme) offers manufacturers a pathway to international recognition through mutual acceptance of test results among participating countries. While not mandatory in most jurisdictions, CB certification significantly reduces testing burdens for multi-market strategies.

GS Mark certification in Germany, though voluntary, carries substantial market value due to consumer recognition and preference for independently verified safety standards.

Commercial vs Residential Requirements Analysis

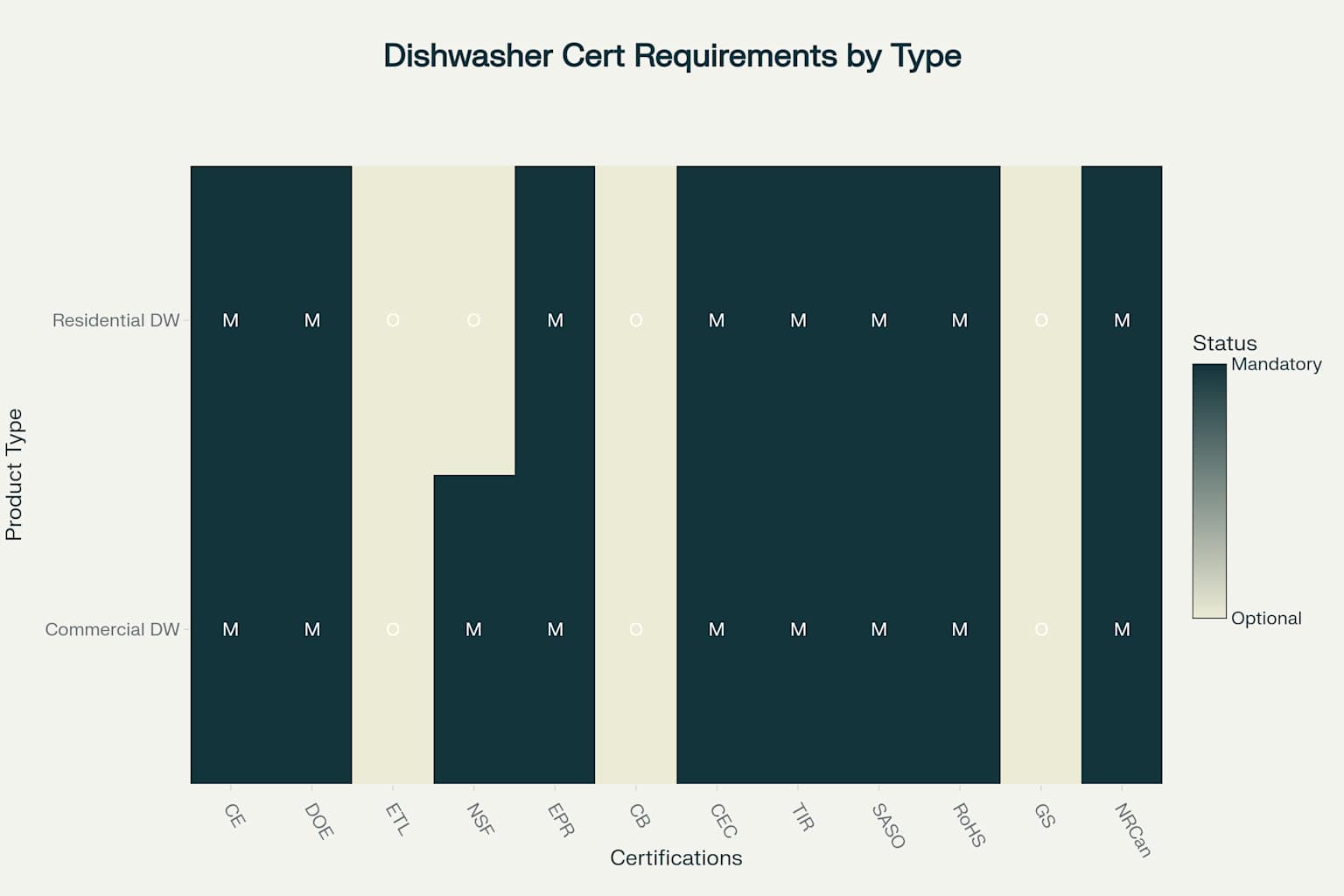

Heatmap showing mandatory vs optional certification requirements for commercial and residential dishwashers across different global certifications

The certification landscape demonstrates clear differentiation between commercial and residential dishwasher requirements. Commercial units face mandatory certification requirements in 75% of assessed schemes, while residential dishwashers encounter mandatory requirements in 67% of cases.

This differential reflects the higher risk environments and professional use expectations for commercial equipment. Commercial dishwashers must meet enhanced sanitation standards, higher durability requirements, and often more stringent electrical safety specifications.

Cost and Timeline Analysis

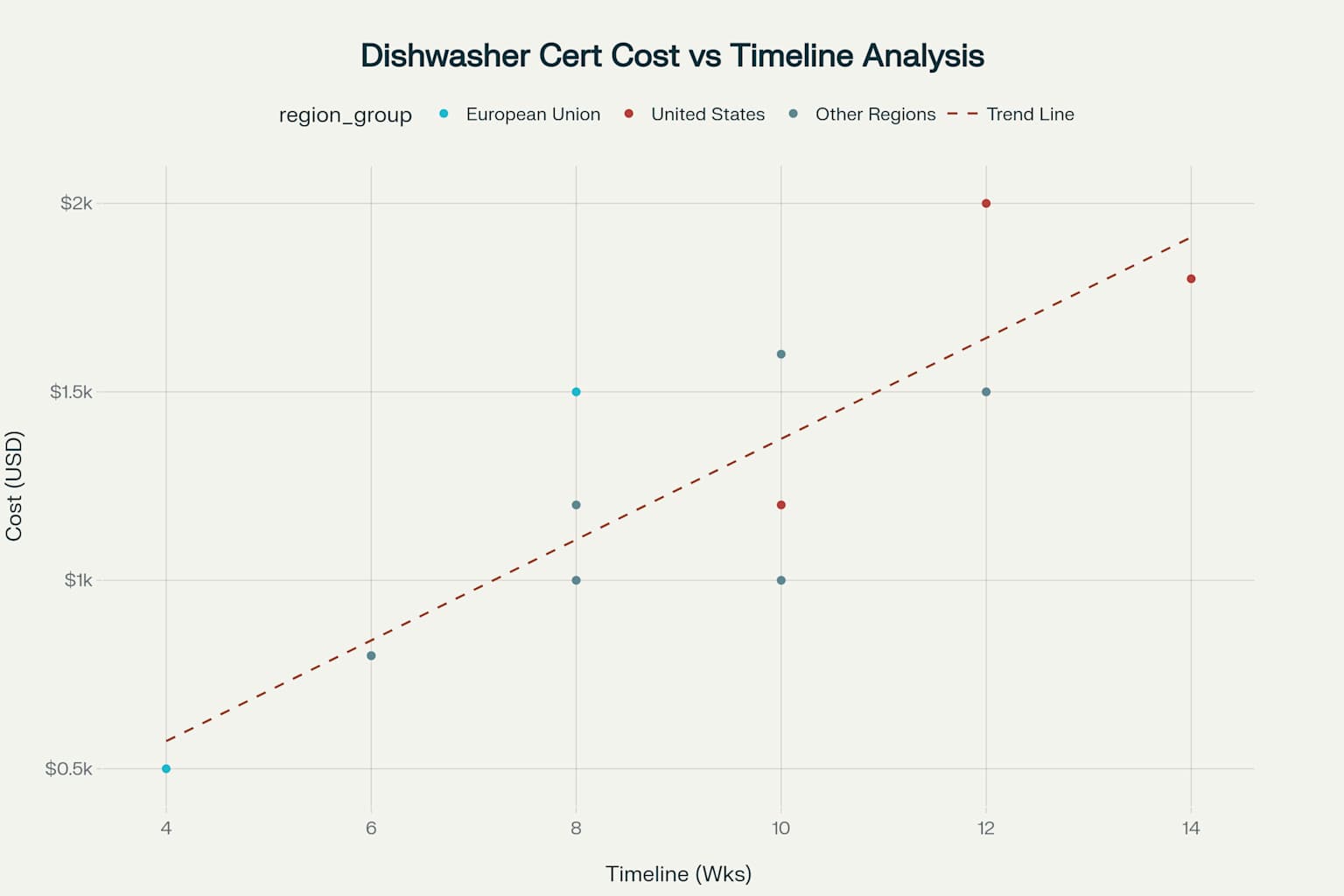

Scatter plot showing the relationship between certification cost and timeline for dishwasher certifications across different global regions

Certification costs across the analyzed schemes range from $500 to $2,000 USD, with timelines spanning 4 to 14 weeks. The cost-timeline analysis reveals several strategic considerations for manufacturers:

Fast-Track Options: EPR registration typically requires only 4 weeks at approximately $500, making it among the most efficient mandatory requirements.

High-Investment Certifications: California CEC certification represents the most time-intensive requirement at 14 weeks, reflecting the detailed energy testing and documentation requirements.

Regional Clustering: US-based certifications (DOE, NSF, CEC) demonstrate higher average costs but provide access to the world’s largest appliance market.

Market Access Strategic Implications

Critical Success Factors

Successful global market access requires strategic certification planning that addresses three fundamental considerations:

Regulatory Sequence: Leading manufacturers typically pursue CE and DOE certifications first, establishing foundational compliance for major markets before expanding to regional requirements.

Cost Optimization: The average certification investment of approximately $15,000 across all mandatory schemes represents 2-5% of typical product development costs, making compliance economically feasible for most manufacturers.

Timeline Management: With average certification timelines of 9 weeks per scheme, manufacturers must initiate compliance processes 12-18 months before planned market entry to accommodate potential delays and retesting requirements.

Compliance Risk Assessment

Non-compliance risks extend beyond simple market exclusion. Recent enforcement trends demonstrate increasing penalties for unauthorized sales, with some jurisdictions imposing fines exceeding $100,000 for significant violations.

The 69% increase in household appliance regulations since 2017 indicates accelerating regulatory complexity, requiring manufacturers to establish robust compliance monitoring systems.

Professional Implementation Recommendations

Based on extensive industry experience, successful certification strategies incorporate several key principles:

Integrated Testing Approach: Manufacturers achieving optimal efficiency coordinate testing activities across multiple certifications simultaneously, reducing both costs and timelines through shared laboratory resources.

Regulatory Intelligence Systems: Leading companies maintain dedicated compliance teams that monitor emerging requirements 18-24 months in advance, enabling proactive adaptation rather than reactive compliance.

Supplier Integration: Component supplier certification status directly impacts final product compliance timelines. Manufacturers increasingly require suppliers to maintain relevant certifications as prerequisite supplier qualification criteria.

Future Regulatory Trends

The certification landscape continues evolving toward greater harmonization and digital integration. Emerging trends include:

Cybersecurity Requirements: Connected dishwashers increasingly face cybersecurity certification requirements, particularly in European and North American markets.

Circular Economy Mandates: EPR obligations are expanding beyond traditional EU markets, with similar frameworks emerging in North American jurisdictions.

Energy Performance Intensification: Ongoing energy efficiency standard updates indicate continuing pressure for improved performance across all major markets.

Conclusion

The dishwasher certification landscape presents both challenges and opportunities for manufacturers seeking global market access. While the regulatory complexity continues increasing, standardized approaches and strategic planning can effectively manage compliance requirements.

Successful market access strategies require early-stage integration of certification requirements into product development processes, comprehensive understanding of regional variations, and proactive monitoring of regulatory evolution. The investment in robust certification management systems pays dividends through reduced market entry timelines and enhanced competitive positioning in an increasingly regulated global marketplace.

The critical nature of most certification schemes means that manufacturers cannot afford selective compliance approaches. Instead, comprehensive certification strategies that address mandatory requirements across target markets represent the most effective pathway to sustainable global market access.