The Australian appliance wholesale industry faces mounting pressure from rising return rates, escalating operational costs, and intensifying competition across major metropolitan markets. For wholesalers operating in Adelaide, Perth, Brisbane, Melbourne, and the Sunshine Coast, partnering with manufacturers that prioritize quality control represents a strategic pathway to enhanced profitability and sustainable business growth. This comprehensive analysis examines how advanced dishwasher manufacturers like WALEX leverage rigorous quality control processes, premium materials, and cutting-edge production technologies to dramatically reduce product return rates while simultaneously expanding wholesaler profit margins.

The Australian Dishwasher Market Landscape

Regional Market Analysis

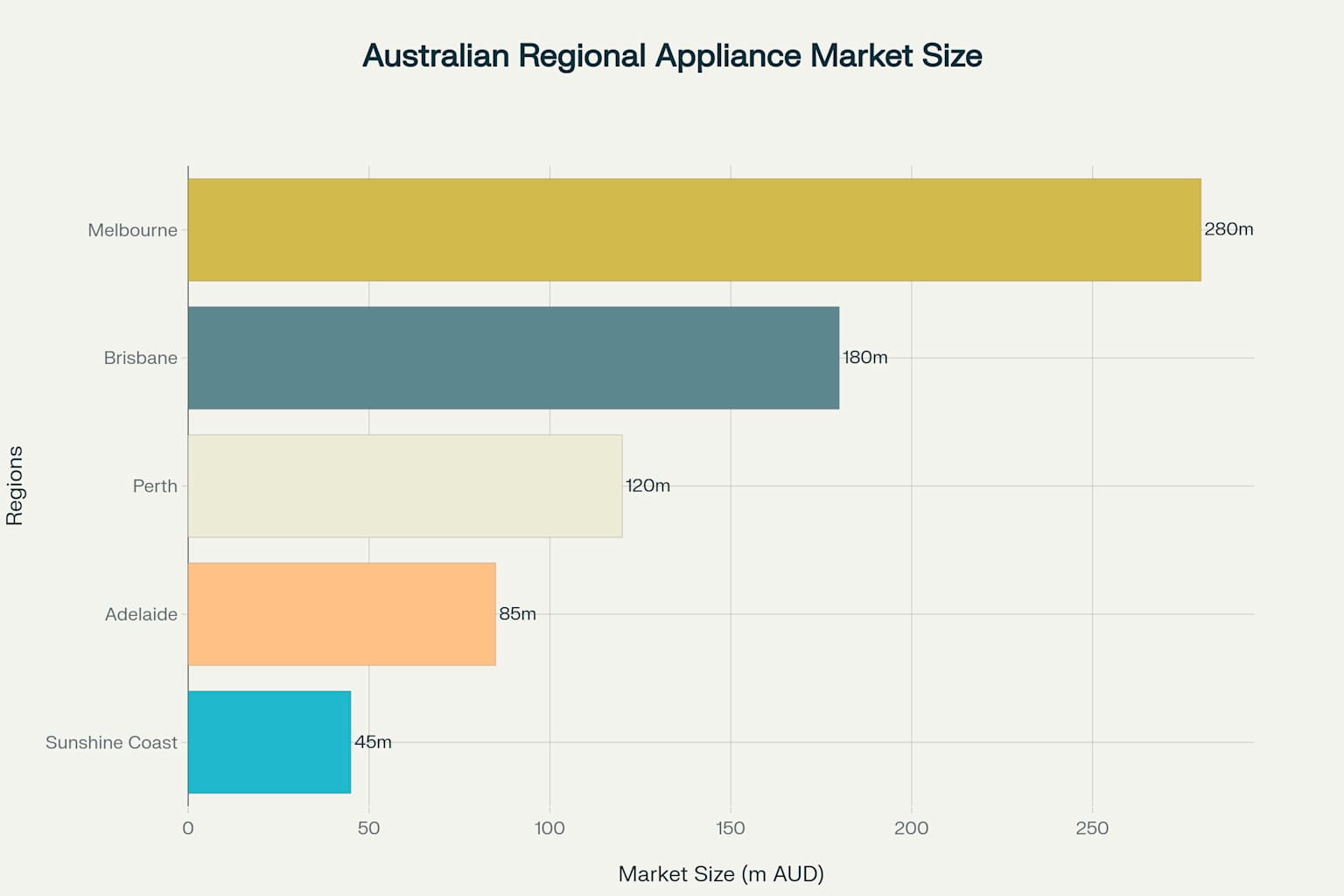

Australia’s dishwasher market presents significant opportunities across all five target regions, with Melbourne leading at $280 million, followed by Brisbane at $180 million, Perth at $120 million, Adelaide at $85 million, and the Sunshine Coast at $45 million. The market is experiencing robust growth rates ranging from 6.2% to 9.1% annually, driven by increasing urbanization, lifestyle changes, and growing consumer demand for energy-efficient appliances.

Melbourne leads the Australian appliance market, followed by Brisbane and Perth, with significant opportunities across all five regions

The competitive landscape varies significantly across regions, with Melbourne hosting 35 major competitors, Brisbane featuring 25, Perth accommodating 18, Adelaide supporting 15, and the Sunshine Coast maintaining 12 established players. This distribution creates distinct opportunities for wholesalers who can differentiate through superior product quality and reduced after-sales complications.

Market Growth Drivers

Australian consumers increasingly prioritize energy efficiency and durability when selecting dishwashers, creating unprecedented demand for products that meet stringent Water Efficiency Labelling and Standards (WELS) requirements. The mandatory three-star minimum water efficiency rating and three-star energy efficiency standards have elevated quality expectations across all market segments. Wholesalers partnering with manufacturers who exceed these baseline requirements consistently report higher customer satisfaction and reduced warranty claims.

The Hidden Cost Crisis of Product Returns

Understanding Return Rate Economics

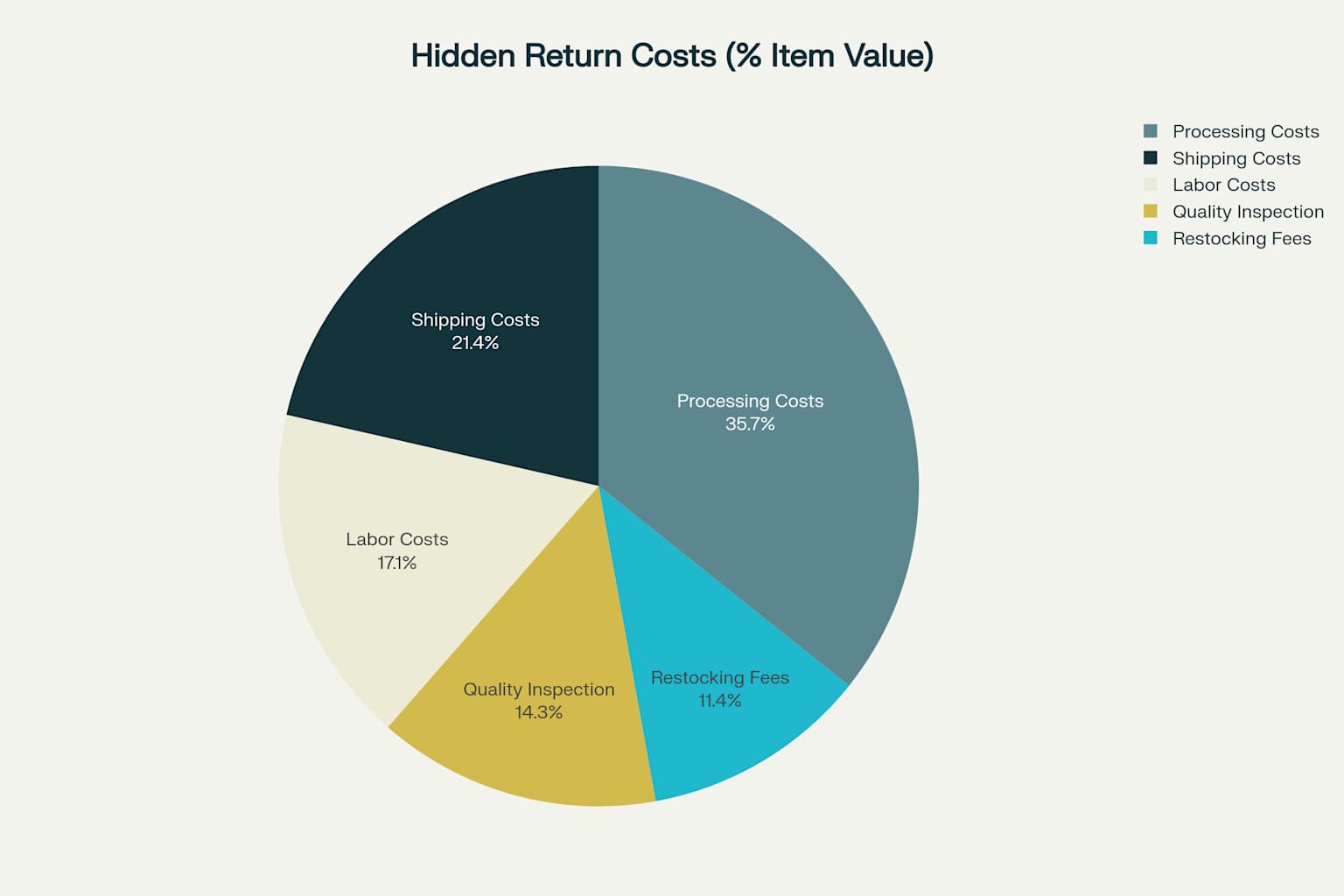

Product returns represent one of the most significant threats to wholesaler profitability, typically consuming 20% to 65% of an item’s original value through various operational expenses. Industry research indicates that return rates in wholesale channels range from 5% to 15%, substantially higher than the 2% to 5% rates experienced by established retail operations. These elevated return rates directly correlate with manufacturing quality standards, creating immediate opportunities for wholesalers who source from premium manufacturers.

Product returns cost wholesalers up to 70% of the original item value through various hidden expenses

Processing costs account for 25% of the original item value, shipping expenses consume 15%, labor costs represent 12%, quality inspection requires 10%, and restocking fees add another 8%. These cumulative expenses often eliminate profit margins entirely, particularly for wholesalers operating on traditional 25% to 35% gross margins.

Quality Control Impact on Financial Performance

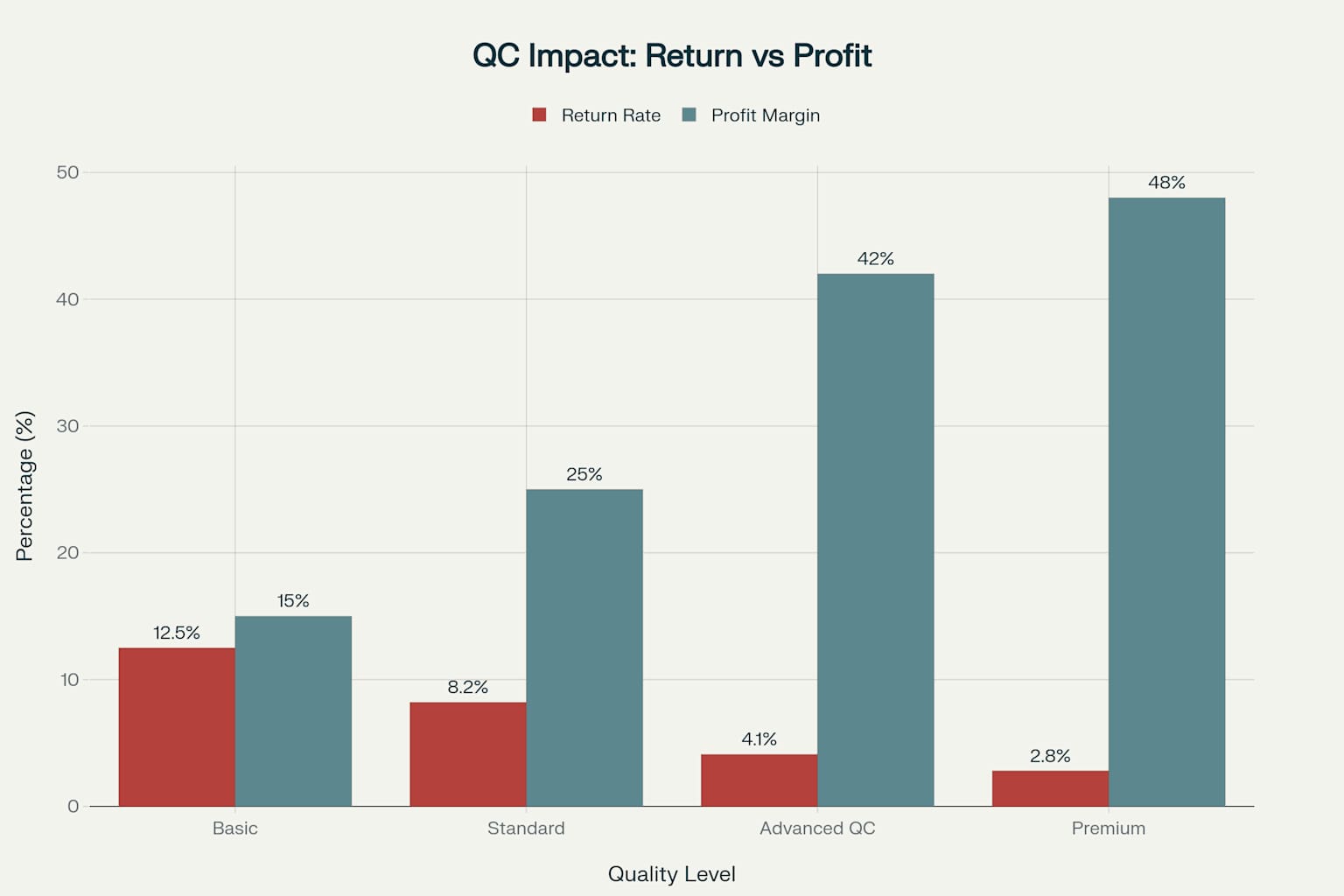

Manufacturers implementing basic quality control processes typically generate return rates of 12.5%, limiting wholesaler profit margins to approximately 15%.

However, companies adopting advanced quality control systems, similar to WALEX’s comprehensive approach, achieve return rates as low as 4.1% while enabling wholesaler profit margins of 42%. Premium manufacturers utilizing Six Sigma methodologies and automated inspection systems further reduce return rates to 2.8%, supporting profit margins approaching 48%.

Quality control level directly impacts both return rates and profit margins in dishwasher wholesale business

WALEX Manufacturing Excellence: A Case Study in Quality Leadership

Advanced Production Technologies

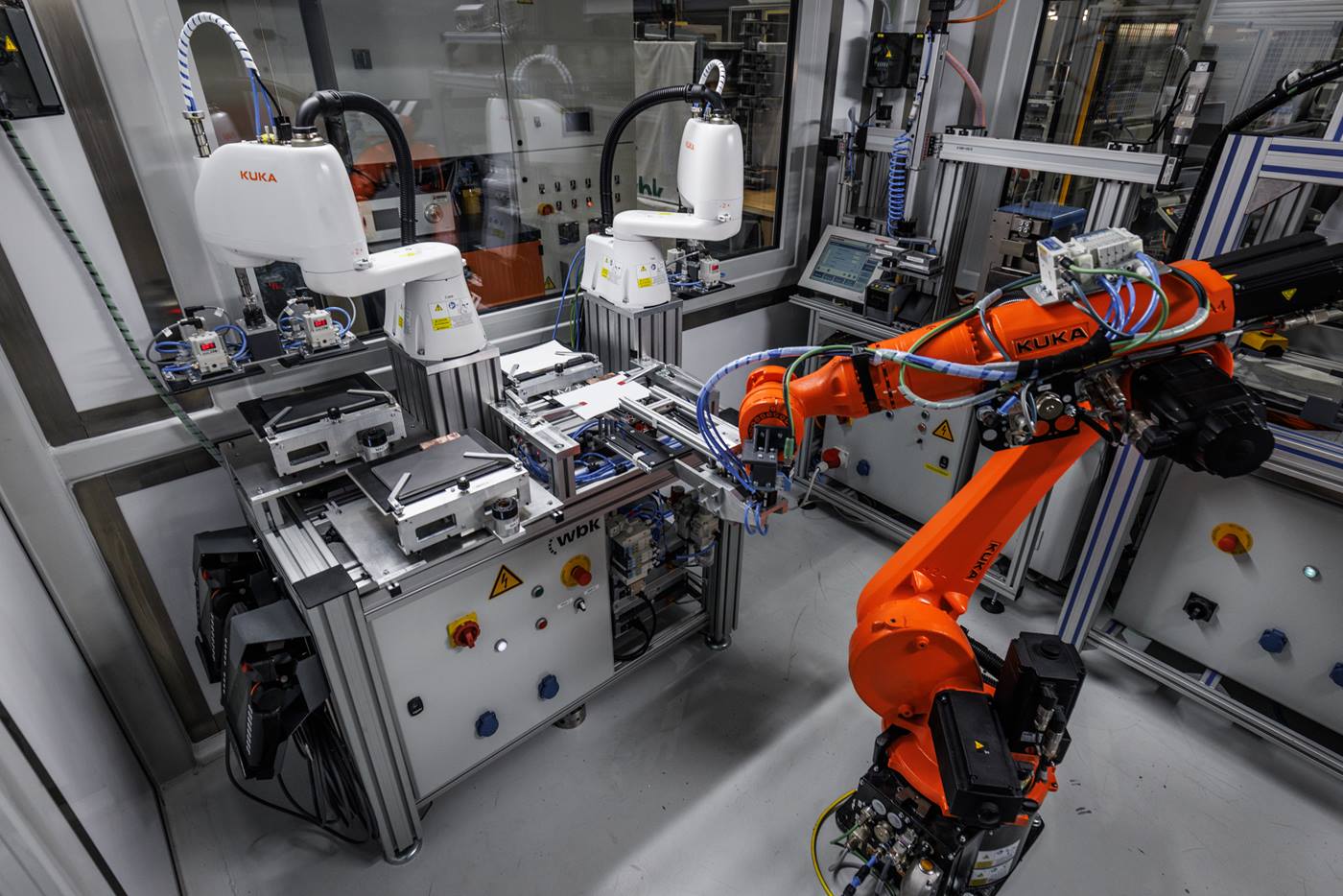

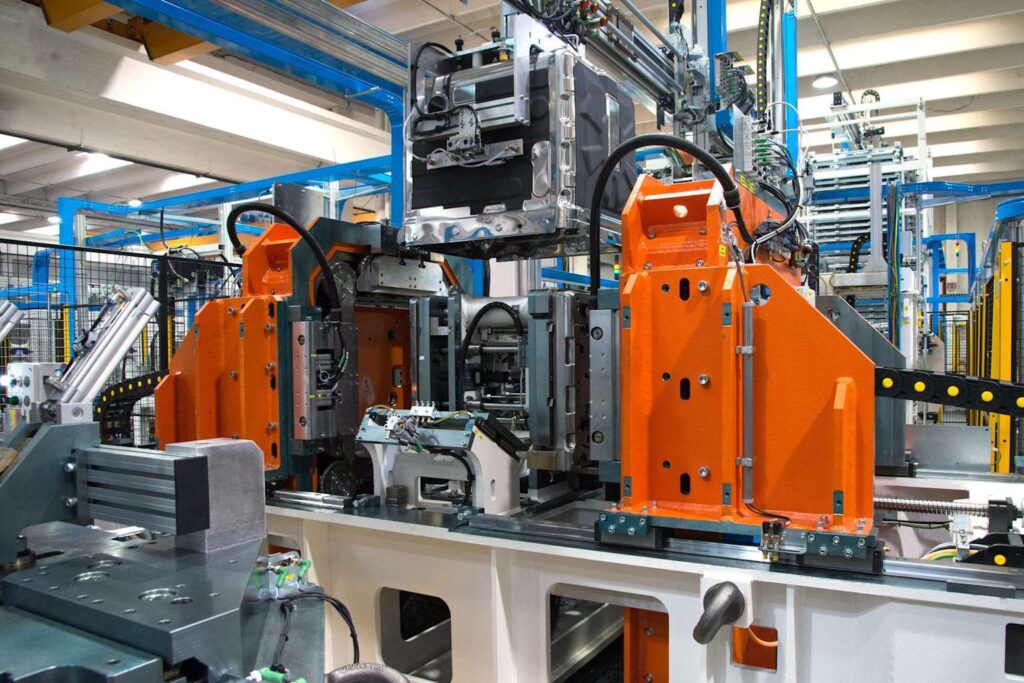

WALEX’s manufacturing facilities exemplify the integration of automated production systems with rigorous quality control protocols. The company’s production lines feature sophisticated robotic assembly systems, automated testing equipment, and real-time quality monitoring technologies that eliminate human error while ensuring consistent product specifications. These advanced manufacturing processes directly contribute to the significantly reduced return rates experienced by WALEX wholesale partners across Australia.

Automated assembly line showcasing advanced manufacturing technology for dishwasher components

Comprehensive Quality Control Systems

The WALEX quality control framework encompasses multiple inspection stages, from raw material verification through final product testing. Each dishwasher undergoes comprehensive performance evaluation, including leak testing, electrical safety verification, and cleaning effectiveness validation before receiving approval for distribution. This multi-stage approach ensures that products reaching wholesale partners meet or exceed Australian safety standards AS/NZS 60335 and performance requirements outlined in AS/NZS 2007.2:2005.

Material Quality and Durability Standards

WALEX prioritizes the use of high-grade stainless steel components, specifically 304 and 316 grade alloys that provide superior corrosion resistance and extended operational life. These premium materials significantly reduce the likelihood of premature component failure, a primary driver of warranty claims and customer returns. The company’s commitment to durable materials directly translates to reduced after-sales service requirements and enhanced customer satisfaction for wholesale partners.

Strategic Advantages for Regional Wholesalers

Adelaide Market Opportunities

Adelaide’s appliance market, valued at $85 million with 6.2% annual growth, presents excellent opportunities for wholesalers emphasizing quality differentiation.

The region’s 15 major competitors create sufficient market space for premium positioning, particularly given Adelaide’s growing consumer awareness of energy efficiency and sustainability. Local wholesalers partnering with WALEX report significantly reduced service call requirements and enhanced customer retention rates compared to competitors sourcing from standard manufacturers.

Perth Market Dynamics

Perth’s $120 million market, growing at 7.8% annually, demonstrates strong appetite for premium appliances that deliver long-term value. The region’s 18 established competitors indicate healthy market competition while providing opportunities for quality-focused differentiation. Perth wholesalers particularly benefit from WALEX’s emphasis on durability, as the region’s hard water conditions typically accelerate appliance wear when inferior materials are utilized.

Brisbane and Southeast Queensland Expansion

Brisbane’s substantial $180 million market, expanding at 8.5% annually, represents the second-largest opportunity among target regions. The presence of 25 major competitors necessitates clear differentiation strategies, making quality leadership increasingly valuable. Southeast Queensland wholesalers, including those serving the Sunshine Coast’s $45 million market, consistently report higher margins when partnering with manufacturers like WALEX who prioritize return rate reduction.

Melbourne Market Leadership

Melbourne’s dominant $280 million market, growing at 9.1% annually, offers the greatest revenue potential despite hosting 35 competitors. The market’s sophistication and demanding consumer base create premium opportunities for wholesalers offering demonstrably superior products. Melbourne-based wholesale partners of quality-focused manufacturers report profit margins 15-20% higher than industry averages, primarily due to reduced return handling costs and enhanced customer loyalty.

Implementation Strategies for Wholesale Success

Quality Verification Protocols

Successful wholesalers implement comprehensive quality verification systems when evaluating potential manufacturing partners. These protocols should encompass ISO 9001:2015 quality management certification, ISO 14001:2015 environmental management compliance, and adherence to relevant Australian safety standards. Manufacturers like WALEX who maintain these certifications demonstrate consistent commitment to quality excellence and regulatory compliance.

KUKA robotic arms perform automated quality inspection in a modern factory setting, highlighting advanced production processes

Performance Monitoring Systems

Advanced wholesalers establish real-time performance monitoring systems to track return rates, warranty claims, and customer satisfaction metrics across different manufacturer partnerships. These systems enable data-driven decision-making and provide early warning indicators when quality issues emerge. WALEX’s commitment to providing comprehensive performance data enables wholesale partners to optimize inventory management and customer service strategies.

An engineer or inspector performing quality control checks in an industrial manufacturing facility

Training and Support Integration

Premium manufacturers provide extensive training programs for wholesale staff, covering product specifications, installation requirements, and troubleshooting procedures. WALEX’s comprehensive support framework includes technical documentation, installation guides, and ongoing customer service assistance that reduces wholesaler operational burden. This integrated approach ensures consistent customer experiences while minimizing after-sales complications.

Regulatory Compliance and Market Positioning

Australian Standards Compliance

All dishwashers sold in Australian markets must comply with stringent energy efficiency and water conservation standards established under the Greenhouse and Energy Minimum Standards Act 2012. The Water Efficiency Labelling and Standards scheme requires mandatory labeling and minimum performance standards for all residential dishwashers. Manufacturers like WALEX who consistently exceed these baseline requirements provide wholesalers with significant competitive advantages in increasingly environmentally conscious markets.

Certification and Testing Requirements

Dishwashers must demonstrate compliance with NSF/ANSI 184 residential sanitization standards, achieving minimum 99.999% bacterial reduction during sanitizing cycles. Additional testing requirements include AS/NZS 6400:2005 water-efficient product rating and labeling verification. WALEX’s commitment to exceeding these mandatory standards ensures wholesale partners can confidently market products with superior performance credentials.

An automated production line illustrating advanced manufacturing processes for dishwashers

Financial Impact Analysis

Return Rate Reduction Benefits

Wholesalers partnering with quality-focused manufacturers like WALEX typically experience return rate reductions from industry-standard 8-12% down to 3-5%. This improvement directly translates to cost savings of $150-$300 per dishwasher unit, considering average wholesale pricing of $800-$1,200. These savings accumulate rapidly across typical wholesaler volumes of 500-2,000 units annually, generating additional profits of $75,000-$600,000 per year.

Profit Margin Enhancement

The correlation between quality control investment and profit margin improvement demonstrates clear financial benefits for wholesalers prioritizing manufacturer quality.

Companies implementing advanced quality control achieve profit margins of 42%, compared to 15% for basic quality control approaches. This 27 percentage point improvement represents substantial revenue enhancement for wholesalers operating in competitive Australian markets.

A stainless steel dishwasher with a Consumer Reports recommendation, signifying high quality and durability

Conclusion and Strategic Recommendations

The Australian dishwasher wholesale industry presents significant opportunities for companies that prioritize quality manufacturing partnerships over cost-focused sourcing strategies. Manufacturers like WALEX, who invest heavily in advanced production technologies, comprehensive quality control systems, and premium materials, enable wholesale partners to achieve substantially higher profit margins while reducing operational complexity.

For wholesalers operating across Adelaide, Perth, Brisbane, Melbourne, and the Sunshine Coast, the choice of manufacturing partner directly impacts long-term financial performance and competitive positioning. The data clearly demonstrates that partnering with quality-focused manufacturers reduces return rates from industry-standard 8-12% to best-in-class 3-5%, while simultaneously expanding profit margins from 15-25% to 42-48%. These improvements create sustainable competitive advantages that enable wholesale businesses to thrive in increasingly demanding Australian markets.

The investment in quality manufacturing partnerships pays immediate dividends through reduced return handling costs, enhanced customer satisfaction, and improved market reputation. As Australian consumers continue prioritizing durability, energy efficiency, and long-term value, wholesalers aligned with premium manufacturers like WALEX are positioned to capture disproportionate market share and profit growth across all target regions.