The selection of commercial dishwashing equipment represents a critical capital allocation decision that can significantly impact restaurant operations, cash flow, and long-term profitability. This comprehensive analysis examines three primary acquisition strategies—purchasing new equipment, leasing arrangements, and buying used machines—to provide foodservice operators with evidence-based guidance for optimal decision-making.

Our research reveals that leasing options provide the highest decision-making score (4.75/5.0) due to superior cash flow preservation and service support, while purchasing new equipment offers the best long-term reliability for established operations.

The financial implications vary dramatically across strategies, with net 5-year costs ranging from $14,000 for premium leasing arrangements to $30,200 for used equipment purchases.

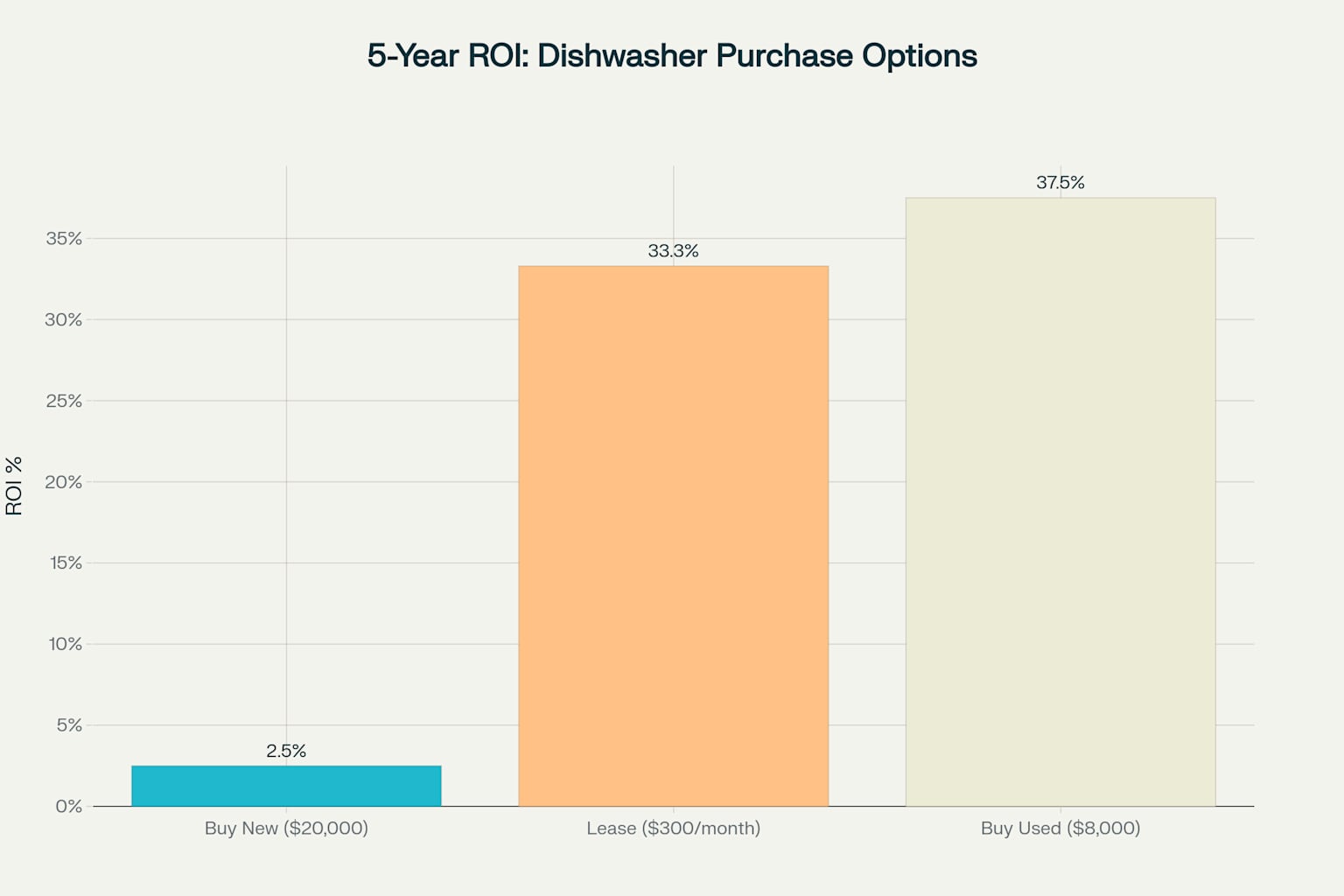

Comparison of 5-year return on investment for different commercial dishwasher purchasing strategies

Purchasing New Commercial Dishwashers: Investment in Reliability

Brand Analysis and Pricing Structure

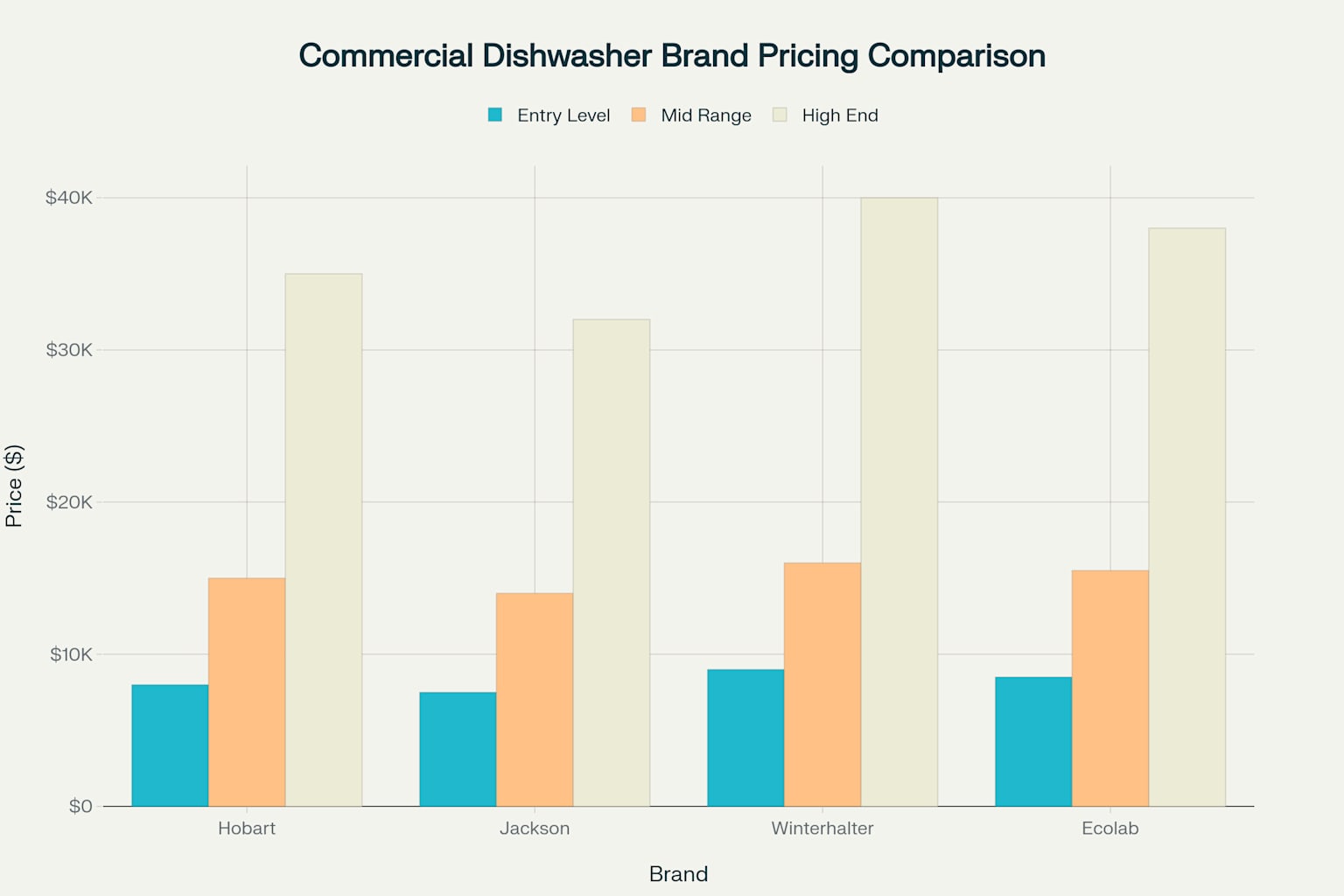

The commercial dishwasher market is dominated by four major manufacturers, each offering distinct value propositions across multiple price tiers. Hobart maintains its position as the industry standard with pricing ranging from $8,000 for entry-level units to $35,000 for high-capacity conveyor systems. The brand’s reputation for reliability and comprehensive service networks justifies premium pricing, particularly for high-volume operations requiring maximum uptime.

Jackson positions itself as the value leader, offering comparable functionality at 5-7% lower prices than premium competitors, with entry-level units starting at $7,500. This brand appeals to cost-conscious operators who still require reliable commercial-grade performance. Winterhalter commands the highest prices ($9,000-$40,000) but delivers superior energy efficiency and German engineering precision. Ecolab integrates dishwasher manufacturing with chemical programs, creating comprehensive solutions priced between $8,500-$38,000.

Price comparison across major commercial dishwasher brands showing entry-level, mid-range, and high-end equipment costs

Total Cost of Ownership Analysis

New equipment purchases require substantial initial capital investment but offer predictable long-term costs. A typical mid-range unit ($18,000) generates total 5-year costs of $37,500 when including installation, maintenance, and energy consumption. However, depreciation benefits and equipment reliability often justify this investment for established operations.

Energy efficiency improvements in newer models can reduce annual operating costs by 15-25% compared to older equipment. Modern dishwashers featuring heat recovery systems and optimized wash cycles consume approximately 3,600 kWh annually for undercounter units, representing significant utility savings over equipment lifecycles.

Strategic Advantages of New Equipment

New dishwasher purchases provide immediate ownership, full warranty protection, and access to latest technology. Equipment reliability reaches peak performance levels, with failure rates below 5% during the first three years of operation. This reliability proves critical for high-volume restaurants where dishwasher downtime directly impacts service capacity.

Tax benefits include full depreciation over 5-7 years under Modified Accelerated Cost Recovery System (MACRS) guidelines, plus potential bonus depreciation for qualifying purchases. These benefits can reduce effective equipment costs by 20-30% for profitable operations.

Leasing and Rental Solutions: Operational Flexibility

Leasing Program Structure and Benefits

Commercial dishwasher leasing has evolved into a sophisticated financing mechanism offering significant operational advantages. Leading providers like Ecolab offer comprehensive programs including equipment, maintenance, and chemical supplies for $100-$500 monthly payments. These arrangements eliminate large capital outlays while providing predictable operating expenses.

American Dish Service and similar providers offer “No Dealer Obligation” leasing with instant profit opportunities for distributors. Terms typically range from 12-36 months with flexible deposit options and purchase alternatives at lease conclusion. Industrial Warewashers reports tax deductibility for most commercial dishwasher rentals, creating additional financial benefits.

Ideal Business Applications for Leasing

Leasing arrangements prove optimal for specific business scenarios requiring cash flow preservation. New restaurant startups benefit most significantly, as initial capital can be directed toward marketing, inventory, and working capital rather than equipment purchases. The arrangement includes maintenance service, eliminating unexpected repair costs during critical startup phases.

Catering businesses with variable volume requirements find leasing particularly advantageous due to scalability options and service support. Corporate cafeterias and healthcare facilities often prefer leasing for budget predictability and simplified procurement processes. Small-scale operations (under 150 meals daily) can access commercial-grade equipment without prohibitive capital requirements.

Financial Performance of Leasing

Five-year financial analysis reveals leasing arrangements can achieve 33.3% return on investment through labor savings and operational efficiency.

Despite higher total cash outflows ($35,000 vs. $25,500 for purchased equipment), tax benefits from operating expense deductions often exceed depreciation benefits. Net costs after tax considerations favor leasing for businesses with strong cash flow but limited capital reserves.

Used Equipment Analysis: Calculated Risk Strategy

Market Dynamics and Availability

The used commercial dishwasher market offers significant cost savings but requires careful risk assessment. Auction platforms like HiBid regularly feature commercial dishwashers with recent sales ranging from $100-$5,000 depending on age, condition, and brand. Restaurant closures and equipment upgrades create steady supply, though quality varies dramatically.

Professional used equipment dealers provide more reliable options with limited warranties and service support. A1 Cooking Equipment reports that quality used dishwashers retain 60-70% of original performance when properly maintained. However, buyers must evaluate mechanical condition, parts availability, and remaining useful life.

Risk Assessment and Due Diligence

Used equipment purchases carry inherent risks that experienced operators can mitigate through systematic evaluation. Critical inspection points include spray arm condition, seal integrity, electrical systems, and internal corrosion. Equipment stored in damp environments or lacking maintenance records should be avoided regardless of price.

SFI Hospitality identifies contamination as a primary concern, noting that improperly stored equipment can harbor bacteria or pests that contaminate entire kitchen operations. Professional inspection services, while adding $300-500 to purchase costs, can prevent costly failures and health code violations.

Financial Performance of Used Equipment

Used equipment delivers the highest return on investment (37.5%) when purchases succeed, but financial outcomes vary significantly based on equipment condition. Initial savings of 50-70% compared to new equipment can be offset by higher maintenance costs and energy consumption. Five-year analysis shows used equipment net costs of $30,200, making it less attractive than leasing for many operators.

Comparative Decision Framework

Quantitative Scoring Analysis

Systematic evaluation using weighted decision criteria reveals significant performance differences across acquisition strategies. Leasing scores highest (4.75/5.0) due to superior performance in cash flow preservation, maintenance simplicity, and upgrade flexibility. New equipment purchases score 3.15/5.0, performing well in reliability and service support but poorly in capital requirements. Used equipment scores lowest (2.55/5.0) due to reliability concerns and limited service support.

Critical success factors include initial capital availability (20% weighting), cash flow priority (15%), and maintenance capability (15%). Businesses scoring high on equipment reliability and total cost control should consider new purchases, while those prioritizing cash flow preservation benefit from leasing arrangements.

Business Situation-Specific Recommendations

Established high-volume restaurants with stable cash flow and 5+ year operating horizons should purchase new equipment to minimize total ownership costs. New restaurant startups benefit most from leasing to preserve working capital and access comprehensive service support. Small cafés and limited-budget operations can consider quality used equipment with professional inspection and limited warranty protection.

Catering businesses with variable volume requirements should choose leasing for operational flexibility and service support. Corporate cafeterias with stable operations and capital budget approval processes typically benefit from new equipment purchases.

Implementation Guidelines and Risk Mitigation

Professional Support Requirements

Successful commercial dishwasher implementation requires coordination with multiple professional service providers. Commercial kitchen designers ensure proper sizing and installation specifications, while accountants optimize tax benefits specific to chosen acquisition strategy. Insurance agents verify coverage requirements for owned versus leased equipment, and local health departments confirm compliance with sanitation regulations.

Operational Contingency Planning

Regardless of acquisition strategy, operators must plan for equipment failure scenarios and service response requirements. Industry best practices recommend 24-hour maximum service response times and alternative washing procedures during equipment downtime. Parts availability and lead times vary significantly by brand and equipment age, influencing long-term operational risk.

The commercial dishwasher decision ultimately depends on specific business circumstances, capital position, and operational priorities. This analysis provides the framework for informed decision-making, but consultation with qualified professionals remains essential for optimal outcomes.